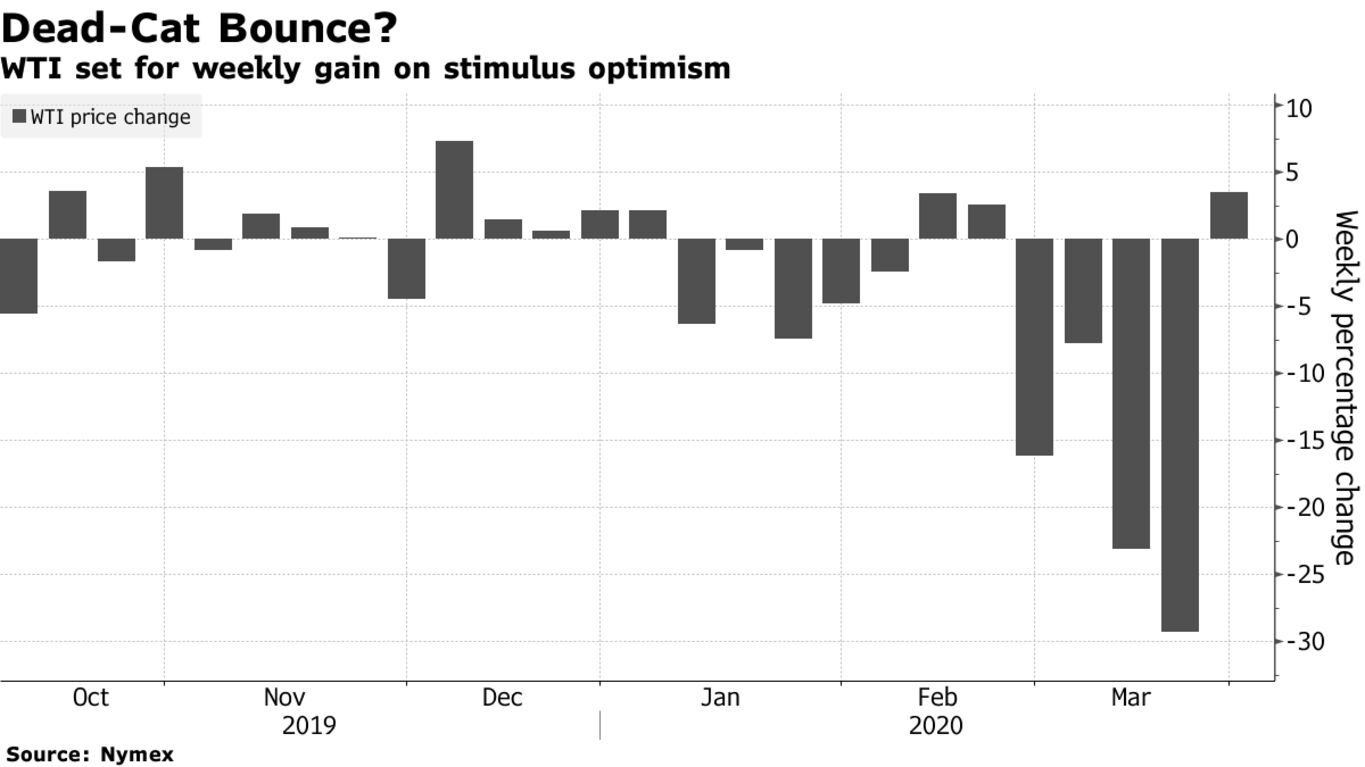

Oil was buoyed by a wider risk rally driven by monetary and fiscal responses to the coronavirus to head for its first weekly gain in five, despite a continued deterioration in demand. Futures in New York edged higher toward $23 a barrel on Friday and are up around 1% this week after losing more than half of their value since mid-February. Global stocks staged a partial recovery this week as central banks sought to cushion the blow from the virus, while the U.S. Senate passed a $2 trillion rescue package for the world’s largest economy.

Crude’s recovery looks fragile though, given the extent of demand loss and the deluge of new supply following the breakup of the OPEC+ alliance. The International Energy Agency warned that oil consumption could fall by as much as 20 million barrels a day, while industry consultant IHS Markit said the world will run out of places to store oil in as little as three months.

The U.S. is urging Saudi Arabia to dial back its plan to flood the crude market, but the window to pressure the kingdom and Russia may already have closed as demand evaporates at a record pace. Any agreement on supply between the three biggest producers will likely be too little and too late, according to Goldman Sachs Group Inc. “The Saudi-Russia price war being called off is now totally irrelevant,” said Vandana Hari, founder of Vanda Insights in Singapore. “It’s now all about how the pandemic affects demand.”