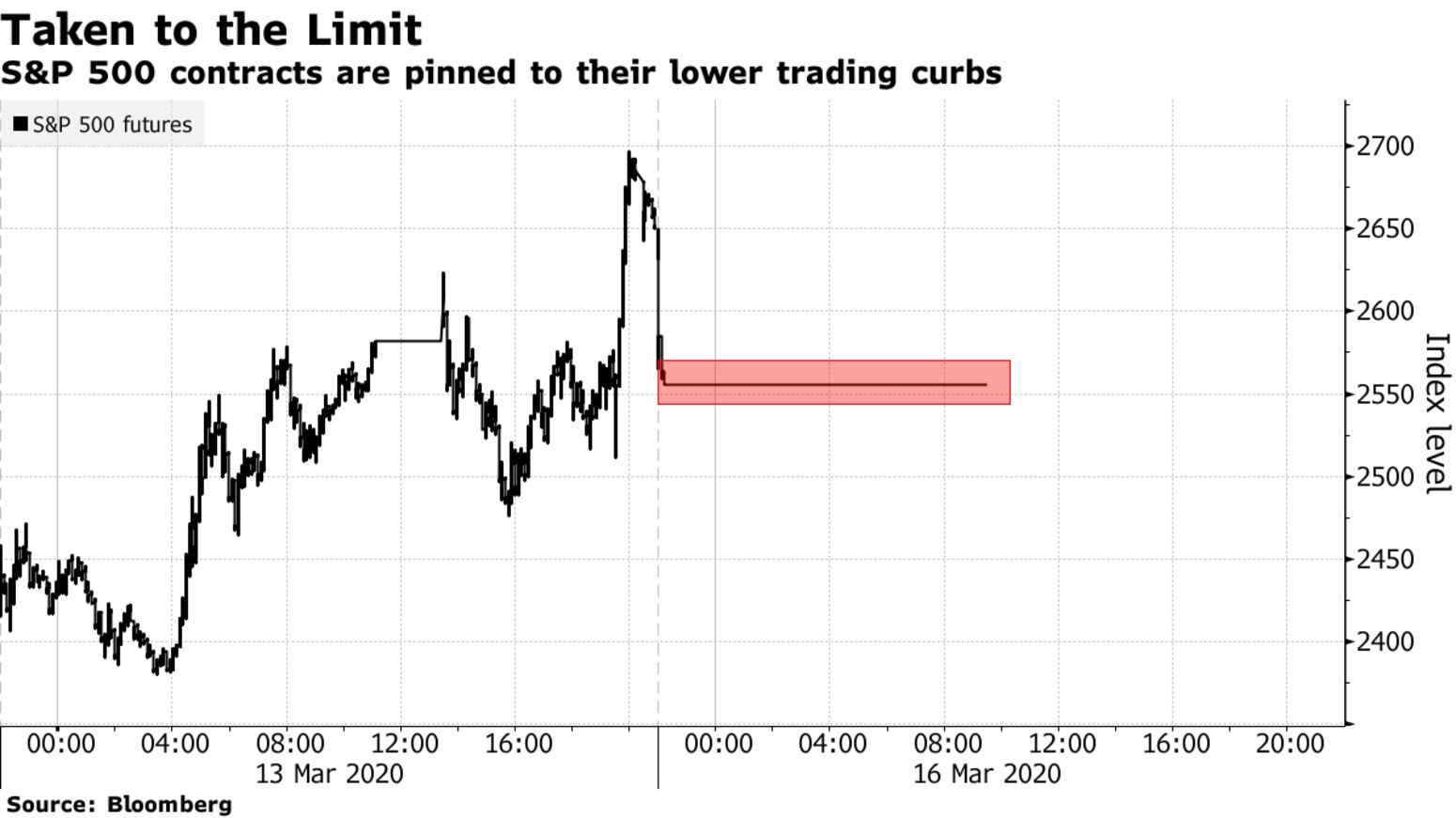

U.S. equity futures tumbled by their limits and Treasuries surged at the start of what’s set to be another volatile week, with investors responding to the rapidly escalating economic hit from the coronavirus and a massive emergency move by the Federal Reserve to ease lending. Contracts on the S&P 500, Nasdaq 100 and Dow Jones Industrial Average all sank almost 5%, tripping their market circuit breakers. Benchmark Treasury yields retreated more than 33 basis points at one point trimming the move. Bonds were mixed in Europe, where a measure of market stress hit levels not seen since the 2011-2012 euro crisis. Shares sank in Asia and Europe, where the continent is now reporting more new virus cases each day than China did at its peak as more countries lock down.

The Fed and other central banks have dramatically stepped up efforts to stabilize capital markets and liquidity, yet the moves fall short of boosting sentiment or improving the rapidly deteriorating global economic outlook. Nike Inc. and Apple Inc. announced mass store closings, and Fed Chairman Jerome Powell said U.S. growth next quarter will be weak.

Investors are struggling to digest a ceaseless newsflow of companies shutting operations, countries sealing borders and governments devising targeted rescue plans. The Fed cut its key interest rate by a full percentage point to near zero and said it will boost its bond holdings by $700 billion. The Bank of Japan moved to accelerate asset purchases, at least for a time, bringing forward its decision from later this week. “In normal circumstances, a large policy response like this would put a floor under risk assets and support a recovery,” Jason Daw, a strategist at Societe Generale SA in Singapore, wrote in a note. “However, the size of the growth shock is becoming exponential and markets are rightfully questioning what else monetary policy can do and discounting its effectiveness in mitigating coronavirus-induced downside risks.”