The U.S. is entering a recession. The ultimate fear is that could turn into a protracted malaise that has some flavor of a depression. That’s far from the base case, with many analysts and investors taking heart from signs of revival in the original epicenter of the coronavirus — China — and predicting a second-half upturn in the U.S. after the contagion hopefully subsides. But as business activity halts and layoffs surge, some prominent economy watchers — including former White House chief economists Glenn Hubbard and Kevin Hassett and former Federal Reserve Vice Chairman Alan Blinder — have drawn comparisons to the Great Depression, though they’ve stopped well short of forecasting another one.

Former International Monetary Fund chief economist Maury Obstfeld said the world hasn’t seen a synchronized interruption in economic output in decades. The best example the University of California, Berkeley, professor can think of: “Well, maybe the Great Depression.”

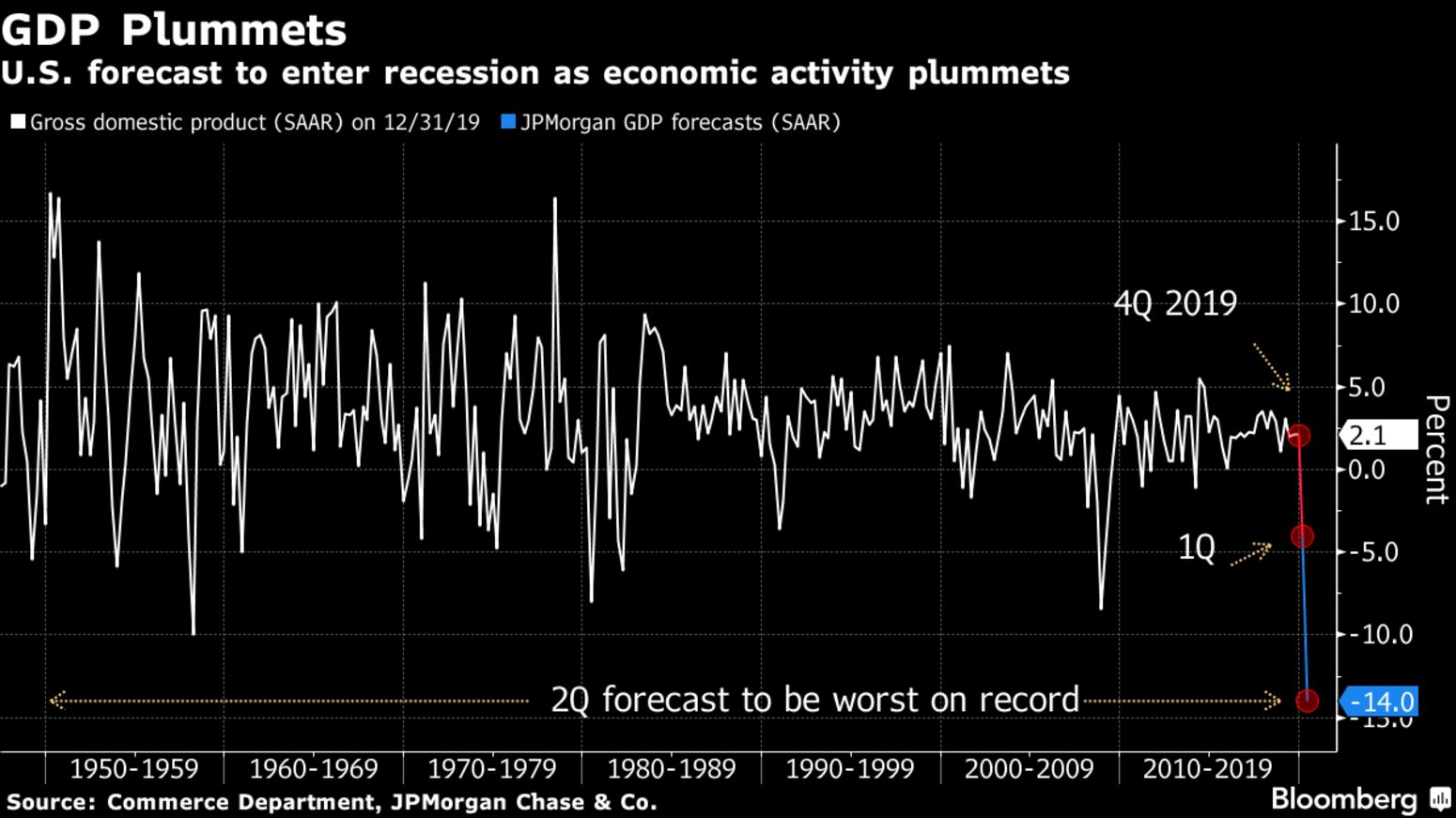

The U.S. undoubtedly will suffer a huge economic contraction as businesses close and Americans stay home. By some estimates, the economy is headed toward its worst quarter in records since 1947. JPMorgan Chase & Co. expects gross domestic product to shrink at an annualized rate of 14% in the April-June period while Bank of America Corp. and Oxford Economics both see a 12% drop. Goldman Sachs Group Inc. sees a 24% plunge. Read More: Morgan Stanley Sees U.S. Economy Plunging 30%