Oil demand in the world’s third-biggest consumer has collapsed by as much as 70% as India endures the planet’s largest national lockdown, according to officials at the country’s refiners. The estimate for the current demand loss is a stark reminder of the challenge facing oil producers as they haggle over a deal to cut supply and prop up the global energy industry. Consumption for the entire month could average about 50% below last year’s levels but that’s based on India’s three-week lockdown ending April 15 as planned, according to the officials.

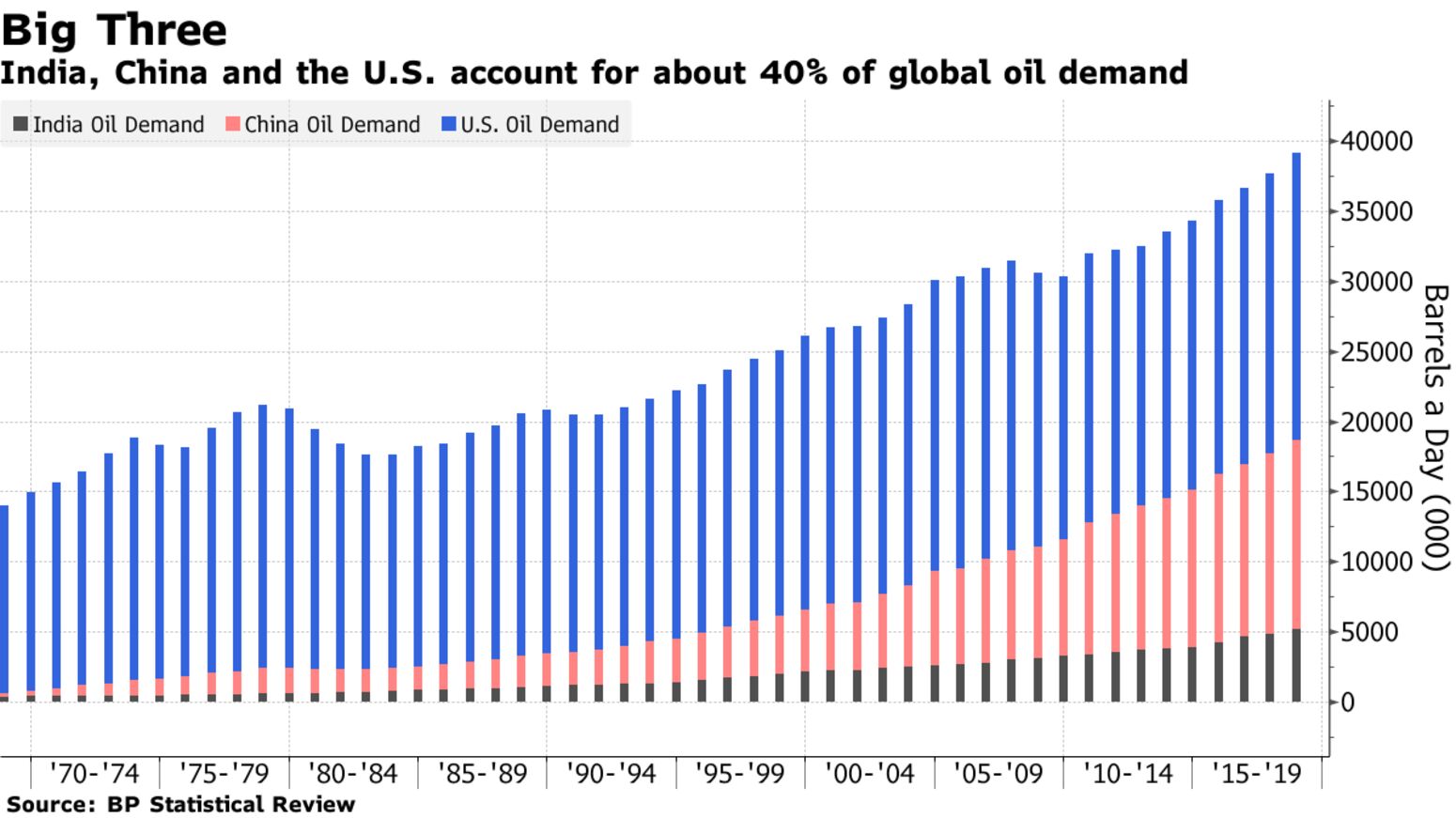

The reduction equates to a staggering 3.1 million barrels a day of lost oil demand, according to data compiled by Bloomberg. To put that in perspective, it means the decline in India alone would eat away a third of the 10 million barrel-a-day supply cut that President Donald Trump last week touted as being under consideration by the world’s biggest crude producers in talks due to culminate this week.

“This is an unprecedented situation, I have neither seen nor heard anything like this in my entire life,” said R.S. Sharma, former chairman of Oil & Natural Gas Corp., India’s biggest producer, which also has two refining units. “There’s lot of turmoil and things are going to worsen,” said Sharma, an oil industry veteran who helmed ONGC during the 2008 financial crisis. India’s March 25 decision to impose a three-week lockdown on its 1.3 billion people was the most far-reaching measure undertaken by any government to curb the spread of the coronavirus. It has helped plunge global energy markets deeper into turmoil just as hopes had started to surface that resurgent Chinese demand could offer some support as the world’s biggest consumer emerged from its own lockdown.

The scale of the demand loss also puts into perspective India’s plans to add to its strategic reserves, a sign of its support for the global measures to help stabilize the oil market. The country has only 15 million barrels of spare capacity in its strategic reserves.