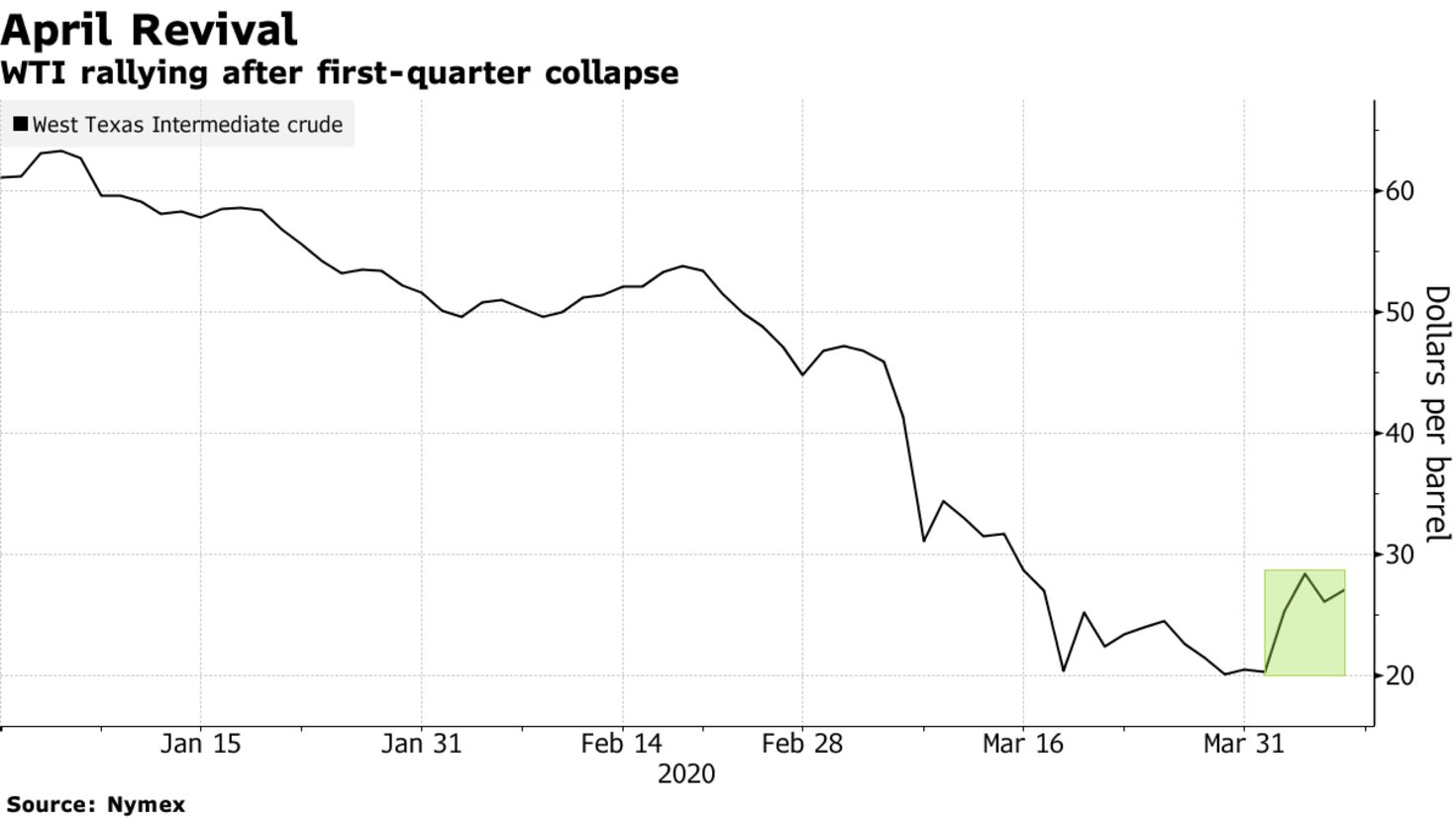

Oil resumed gains on signs that the world’s biggest producers are moving toward a deal to end their price war and cut output as the coronavirus eviscerates energy demand. Futures in New York rose 3.6% to trade near $27 a barrel. Saudi Arabia and Russia are closing in on an output deal, according to people familiar with the matter. They plan talks with other OPEC+ countries on Thursday before a G-20 meeting of energy ministers Friday. In the U.S., President Donald Trump’s top energy official said he had a productive discussion with his Saudi counterpart.

While the talks still face significant obstacles, not least agreeing on numbers everyone can live with and potential U.S. involvement, the bigger question is whether any deal will be enough given the extent to which the virus is destroying demand. Stockpiles at the U.S. storage hub of Cushing, Oklahoma, may have risen the most last week since at least 2004, while Indian buyers are looking to cancel some April and May oil shipments. “Judged by the bout of optimism reflected in prices of oil futures in recent days, the market is still not realizing the severity of the oversupply problem coming in April-May,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy.

An effective deal will require all of the three top producers — the U.S., Saudi Arabia and Russia — to participate. While Riyadh and Moscow are set to cut output significantly, according to people with knowledge of the negotiations, Washington is more likely to offer up gradual reductions. The G-20 may be a more acceptable forum to bring on board the U.S. and other big producers outside the OPEC+ alliance, such as Canada and Brazil.