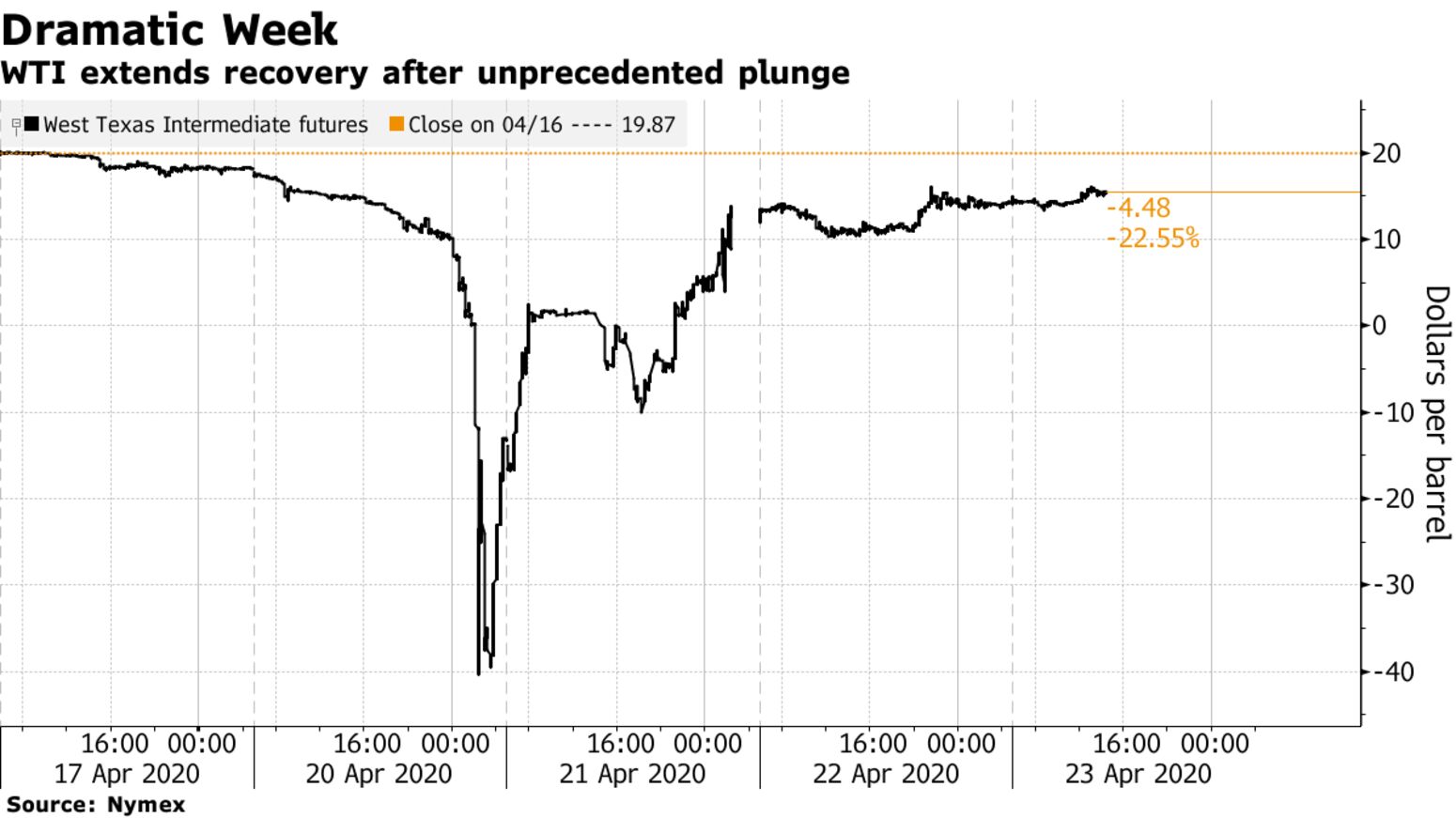

Oil extended its recovery from Monday’s plunge below zero, but trading remains volatile with the market under intense pressure from a swelling global glut. Futures in New York rose as much as 17% to top $16 a barrel. Already inundated with bearish signals, the market shrugged off data from Wednesday showing U.S. crude stockpiles at a three-year high and petroleum demand at a record low. An order by President Donald Trump authorizing the Navy to destroy any Iranian gunboats harassing American ships also lent some support.

Prices remain down 75% this year, and more production shut-ins are likely as the value of real oil crashes globally. ICE Futures Europe Ltd. confirmed Tuesday that it had taken steps to prepare for negative Brent pricing, while the Chicago Mercantile Exchange took similar measures earlier in the week. Meanwhile, oil traders are rewriting their risk models to accommodate potentially limitless declines.

OPEC+’s deal to slash daily production by about 10 million barrels a day will only take effect from May 1 and will in any case prove insufficient to offset demand losses that could reach 30 million barrels a day. In the U.S., the world’s biggest oil producer, operators have started shutting wells and halting drilling, steps that could cut output by 20% and leave thousands of workers unemployed. “While some may see negative WTI pricing earlier this week as a quirk of the futures market, it’s an ominous sign,” said Victor Shum, vice president of energy consulting at IHS Markit. It “reflects brutal market forces that are forcing supply to adjust to a much lower level of world oil demand.”

| PRICES: |

|---|

|