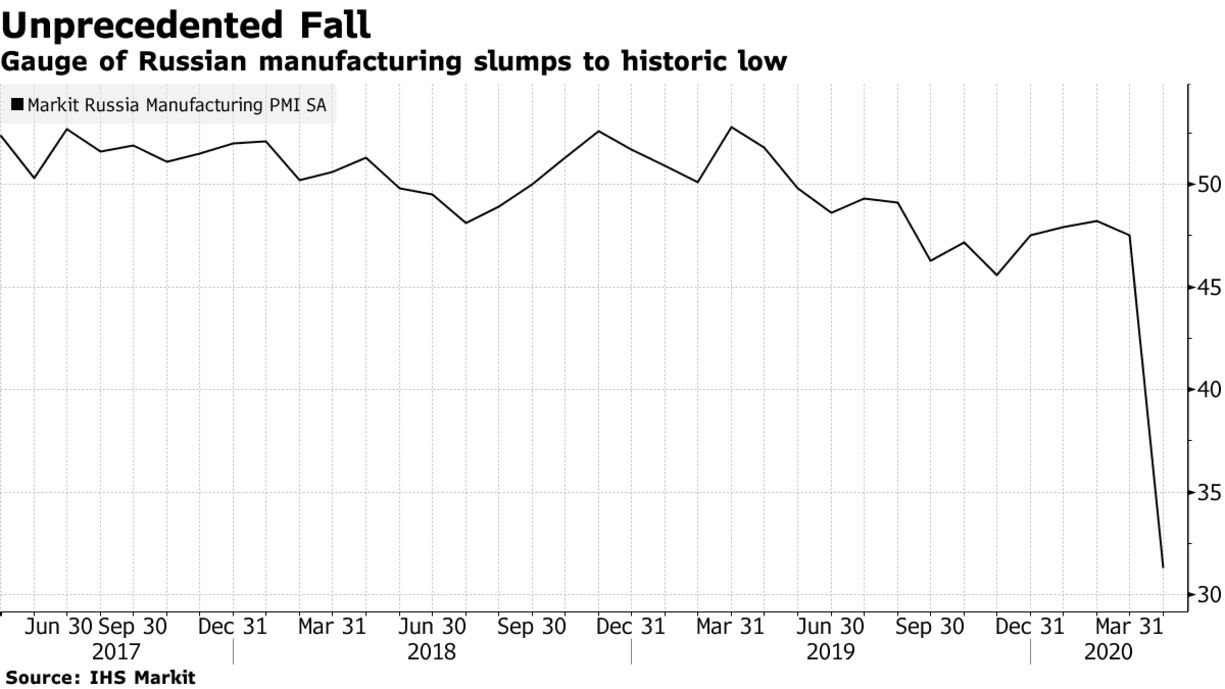

A gauge of Russian manufacturing slumped to the lowest level since records began in 1997 as lockdowns across Europe choked demand. The Manufacturing Purchasing Managers’ Index fell to 31.3 in April, down from 47.5 in March, IHS Markit said on Thursday. The median estimate of eight economists surveyed by Bloomberg was for 40.5.

“Output and new orders contracted at unprecedented rates as domestic and foreign client demand slumped,” Sian Jones, an economist at IHS Markit, said in a statement. “A depreciation of the ruble and supplier shortages drove costs higher, with some firms still partly able to pass costs on to clients.” The indicator gives the first sign of how badly Russia’s economy could be hit by the fallout from the coronavirus. Russian President Vladimir Putin could be heading for the deepest contraction of his 20-year reign as the world’s biggest energy exporter takes a double blow from the pandemic and the slump in oil prices.

What Our Economists Say:

“The PMI points to widespread pain, though it doesn’t tell us how deep the cuts to output have been. Activity may be down by a third overall, with more losers than winners.”

–Scott Johnson, Bloomberg Economics

A 15% slump in the ruble against the dollar this year has created an additional burden for factories that rely on imported goods. Industrial production, which surprised to the upside in March, may decline 3.8% this year, IHS Markit said. A partial lockdown imposed late last month has been extended to May 11. The measures limit business where there is face-to-face contact with clients, halting activity in restaurants, non-food stores and fitness centers. Factories continued working, though some cut working hours. The International Monetary Fund forecast a 5.5% contraction in the Russian economy this year, about double the rate it expects for the world as a whole. A recovery next year is forecast to be slower than in most other countries.