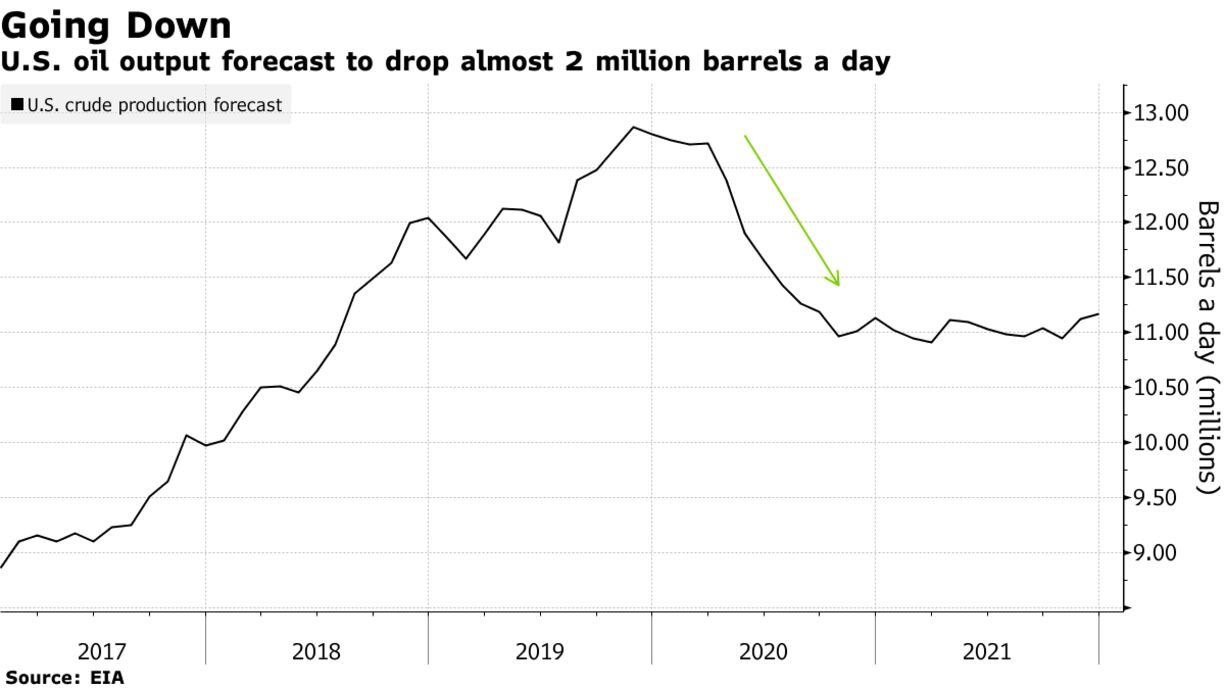

President Donald Trump said the “big Oil Deal” sealed on Sunday will save hundreds of thousands of American jobs. But the agreement he brokered depends on a sharp downturn in shale that will likely bring about a wave of bankruptcies and job cuts. Days of frantic diplomatic maneuvering culminated in an agreement on Sunday by OPEC+ to pare production by 9.7 million barrels a day, ending a devastating price war between Saudi Arabia and Russia and belatedly tackling a plunge in demand caused by the coronavirus outbreak. The lockdowns enacted across much of the world to slow its spread have caused consumption to crater by as much as 35 million barrels a day.Rather than agree to any formal cuts, Trump is counting on market forces to shave some 2 million barrels a day of overall U.S. output by the end of the year. U.S.-focused oil producers have already slashed more than $27 billion from drilling budgets this year and are starting to shut in production. That could spell the end for some shale explorers drowning in debt.

“Trump’s strategy seems to rely on the free market forcing production down and implicit in that is some companies going under,” said Dan Eberhart, a Trump donor and chief executive of drilling services company Canary Drilling Services.

Almost 40% of oil and natural gas producers face insolvency within the year if crude prices remain near $30 a barrel, according to a survey by the Federal Reserve Bank of Kansas City. Oil producer Whiting Petroleum Corp. and service provider Hornbeck Offshore Services Inc. filed for bankruptcy last week. Explorers idled 10% of the U.S. oil-drilling fleet, with more than half of the losses in the Permian Basin of West Texas and New Mexico, the heart of America’s shale industry, while Concho Resources Inc. said Friday that it and other producers are shutting in output.