Oil extended losses after an industry report showed a surprise jump in U.S. crude stockpiles last week. West Texas Intermediate crude futures fell as much as 3.2% after the close in New York. The industry-funded American Petroleum Institute reported that U.S. crude stockpiles rose 8.73 million barrels last week, according to people familiar with the data. Gasoline supplies also gained 1.12 million barrels, according to the report.

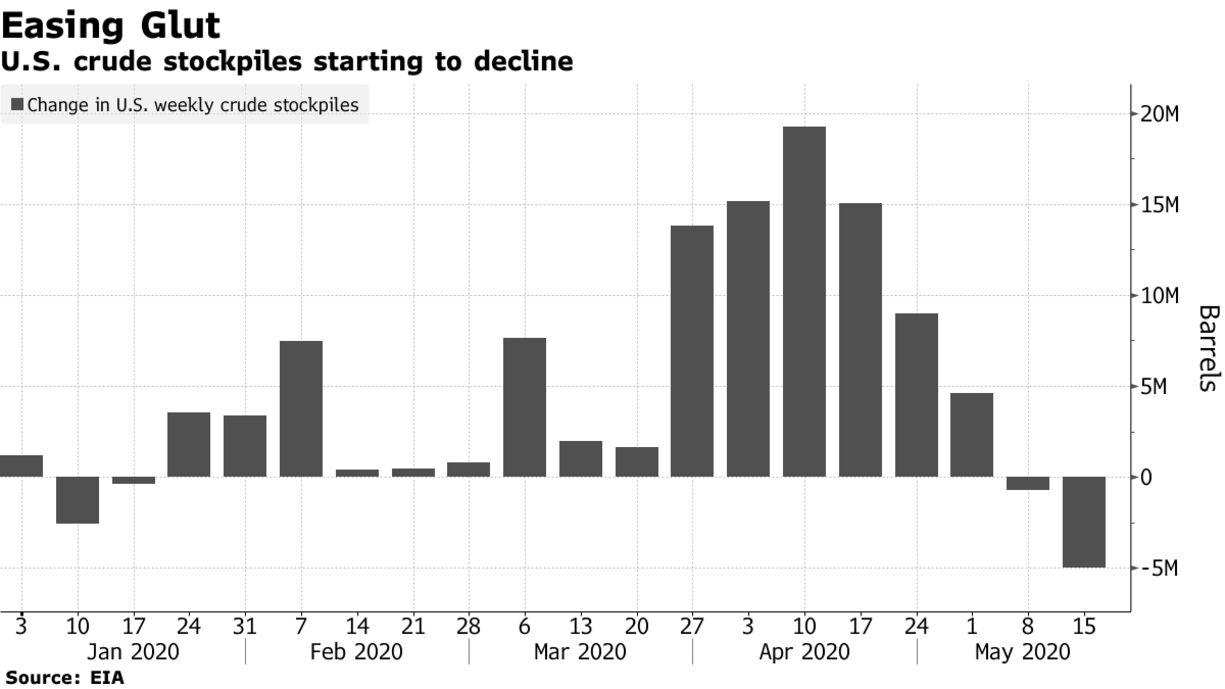

If confirmed by government data Thursday, the crude build would reverse two weeks of inventory declines — an indication that record supply cuts are not draining a massive supply glut fast enough. While oil has rallied about 70% this month, the market’s recovery from an historic crash remains fragile, with higher prices likely prompting producers to turn the taps back on even as the pandemic continues to quash energy demand.

The API report also showed supplies at the key storage hub of Cushing, Oklahoma, fell by 3.37 million barrels, which would be the third consecutive weekly decline. The Energy Information Administration will release its weekly inventory report Thursday morning.