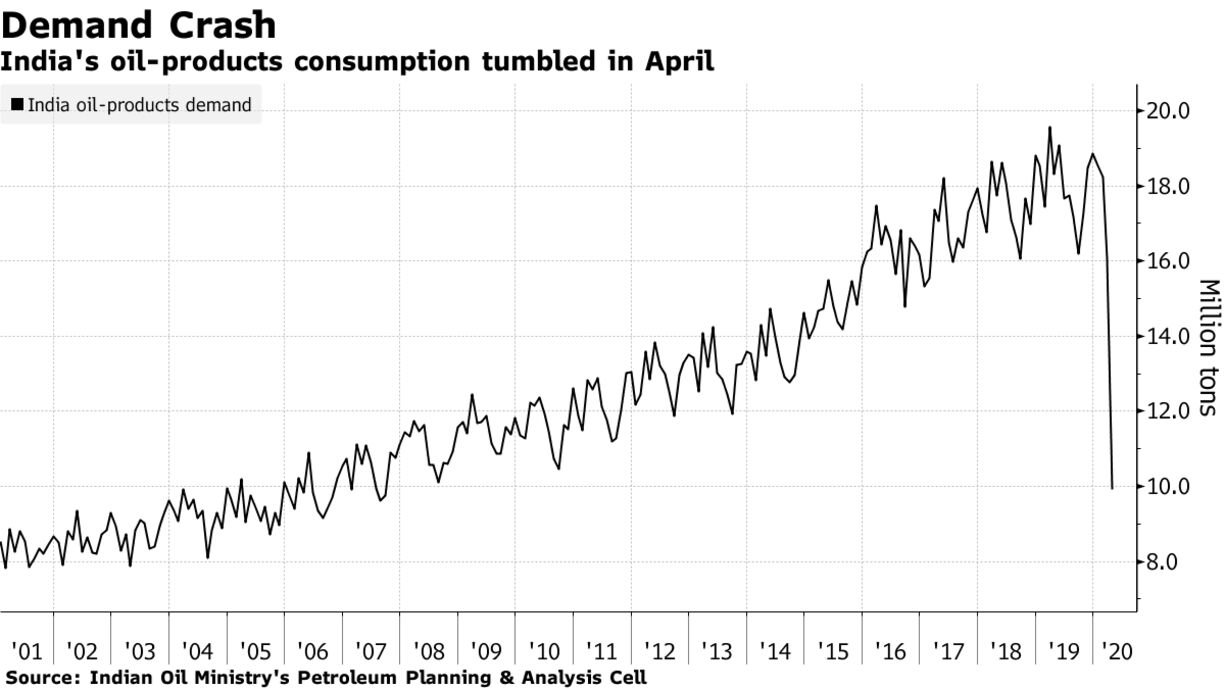

Oil pared last week’s gain as fears of a potential resurgence in global coronavirus cases countered tentative signs of a demand recovery. Futures fell 2.3% in New York to trade near $24 a barrel. China put Shulan, a city near the North Korean border, in lockdown over the weekend, while in the U.S., the White House was hit with a case of the virus even as President Donald Trump encouraged Americans to return to work. In India, data showed that consumption of oil products slumped 46% in April to a 12-year low.

“Weakness persists,” said SEB chief commodities analyst Bjarne Schieldrop. With a new virus lockdown in China, it is “not so strange that crude-oil prices are giving back some of their strong gains from last week.”

| PRICES |

|---|

|

There are signs that gasoline demand is picking up as parts of the world reopen for business. And in China, an economy emerging gradually from lockdown, oil stockpiles have shrunk in recent weeks after previously swelling to a record.