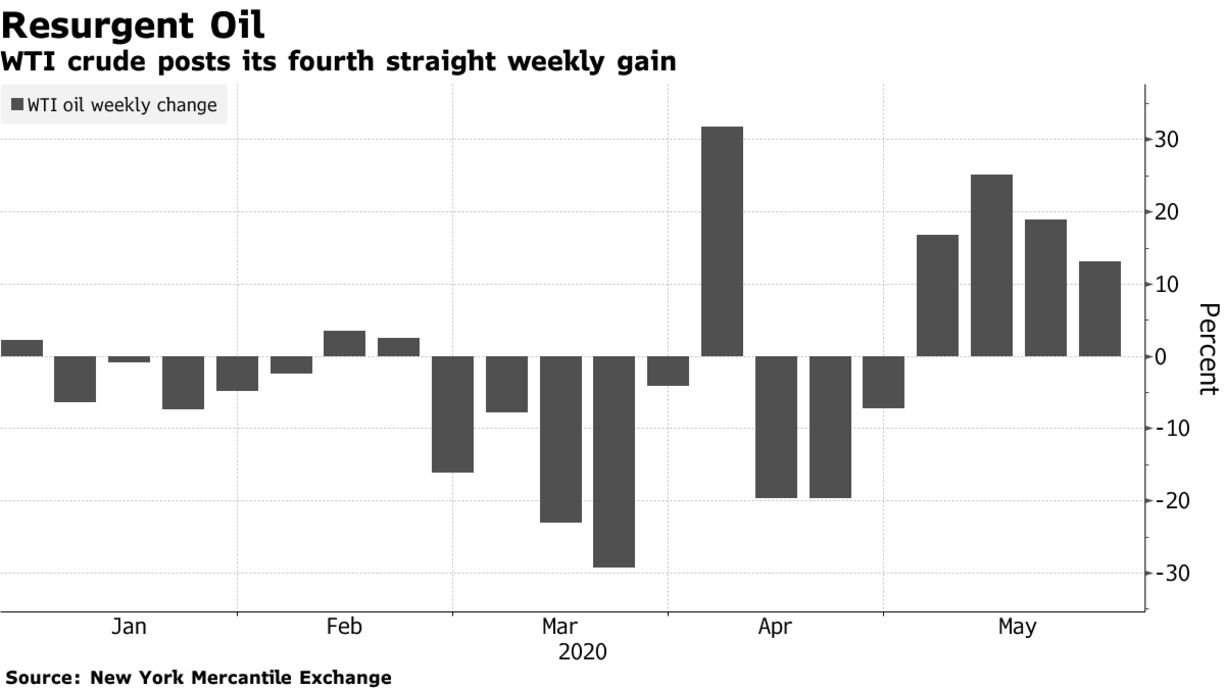

l fell, paring a weekly gain, as investors weighed improving supply fundamentals against doubts surrounding China’s economic growth. Futures in New York slid 2% Friday but notched a 13% increase for the week. Major producers continue to scale back production. U.S. explorers laid down another 21 oil rigs, bringing the total to the lowest since 2009. Beijing abandoned its economic growth target for this year due to “great uncertainty” over the coronavirus, triggering concerns over a demand recovery.

“We are starting to see some gradual improvements in the global economy, notwithstanding China, and it’s going to get better from here,” said Bill O’Grady, chief market strategist at Confluence Investment Management LLC. “So, we’ve gone from being undervalued due to fears of the lack of inventory capacity to now being about where we ought to be based on where inventories are.”

However, there are still warning signs that any recovery will be long and slow. The research unit of state-owned China National Petroleum Corp. said fuel demand in the country will drop by 5% this year. Plus, U.S. oil production shut-ins have peaked, Mark Rossano, an analyst with consultancy Primary Vision said.