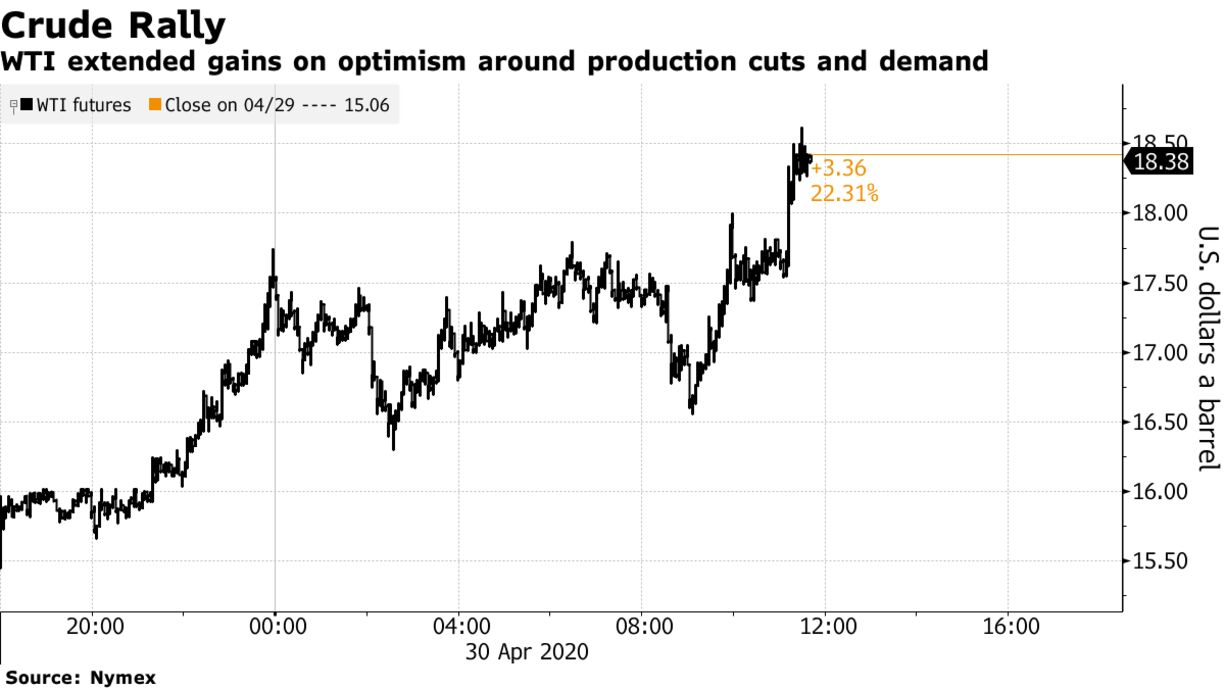

Oil climbed for the second day as global production cuts deepened and signs of a recovery in physical markets emerged. Futures in New York soared as much as 29% in volatile trading Thursday. Royal Dutch Shell Plc said that upstream oil and gas production could fall by as much as a third, while ConocoPhillips said it will reduce output by over 400,000 barrels a day in June. Norway said it will cut production by 250,000 barrels a day in June and 134,000 barrels in the second half of the year.

“The industry is responding like it’s a five-alarm fire,” said John Kilduff, partner at Again Capital LLC, regarding productions cuts. “The cutbacks being announced and undertaken are real and are going to be significant, so that’s helping to support prices.” He added that volume is low in the June contract, which is yielding volatile price swings. “June is a very choppy contract. It’s going to get pushed around a lot,” he said.

Although crude oil in the U.S. has crept higher from negative territory earlier this month, Citigroup Inc. warned the worst is likely yet to come in the oil market. Global storage is nearing its limits even as a recovery in demand begins, analysts including Ed Morse said. Saudi Arabia crude exports in April skyrocketed to about 9.4 million barrels a day — the highest level in at least three years — due to soaring shipments to China, India and the U.S. The surge was, in part, a result of the kingdom slashing its official selling prices last month.