Saudi Arabia’s outlook was cut to negative from stable by Moody’s Investors Service as the crash in oil prices and the pandemic sent the kingdom’s reserves plunging to their lowest in almost a decade. The rating company kept the sovereign at A1, its fifth-highest grade, according to a statement on Friday. Moody’s last downgraded Saudi Arabia in 2016, and has its assessment above those of Fitch Ratings and S&P Global Ratings.

“The negative outlook reflects increased downside risks to Saudi Arabia’s fiscal strength stemming from the severe shock to global oil demand and prices triggered by the coronavirus pandemic,” Moody’s analysts led by Lucie Villa wrote. “A sharp slowdown in GDP growth will also depress revenue from the non-oil sector.”

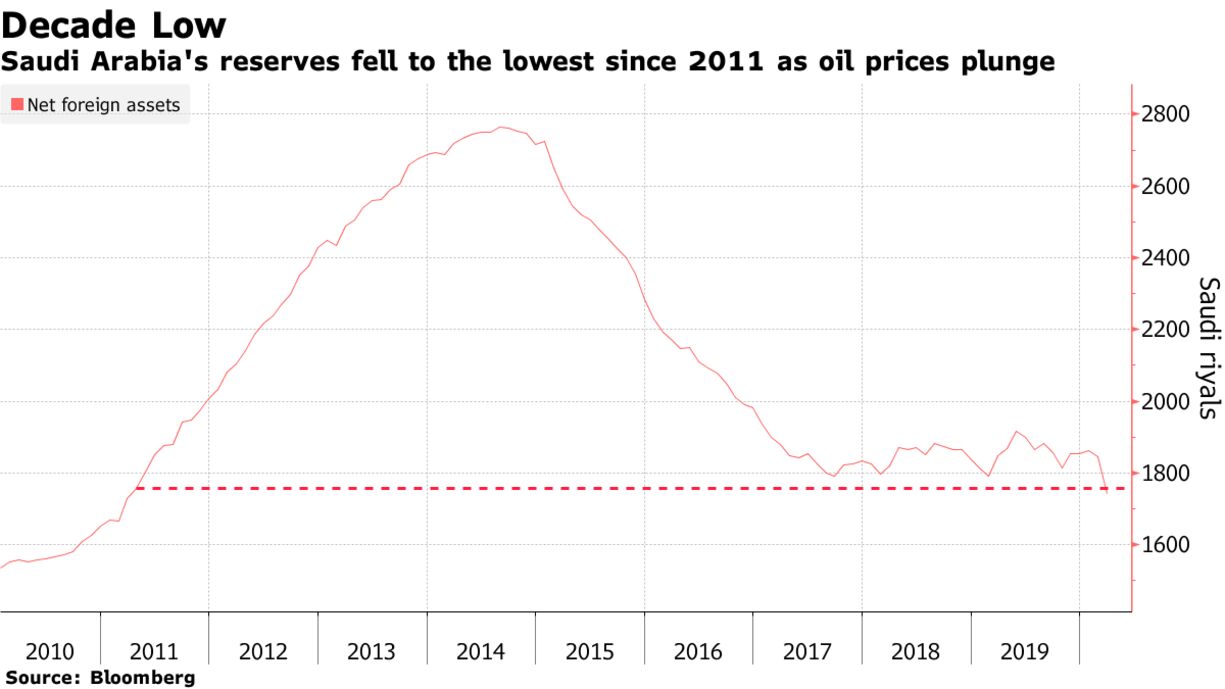

Under strain from the coronavirus and collapsing oil prices, Saudi Arabia is headed for an economic contraction this year while increasingly drawing down its savings. In March alone, the central bank’s net foreign assets fell by more than 5%, or more than 100 billion riyals ($27 billion).

The government is looking to its largest-ever debt program to keep the depletion of reserves at up to 120 billion riyals, as originally planned in the budget. Finance Minister Mohammed Al-Jadaan has also laid out plans to scale back spending after already cutting 50 billion riyals in expenditure.

Last month, the kingdom sold $7 billion of bonds, marking the second time this year the world’s largest oil exporter has turned to international capital markets.

Moody’s projects that Saudi’s fiscal deficit will widen to more than 12% of GDP in 2020 and more than 8% in GDP in 2021 from 4.5% of GDP in 2019. This will cause government debt to increase to around 38% of GDP by the end of 2021 from less than 23% of GDP in 2019, according to the statement.

The price of Brent crude crashed by more than 50% in March and fell further since. It trades around $27 a barrel — far short of the $76.10 the International Monetary Fund estimates Saudi Arabia needs to balance its budget.