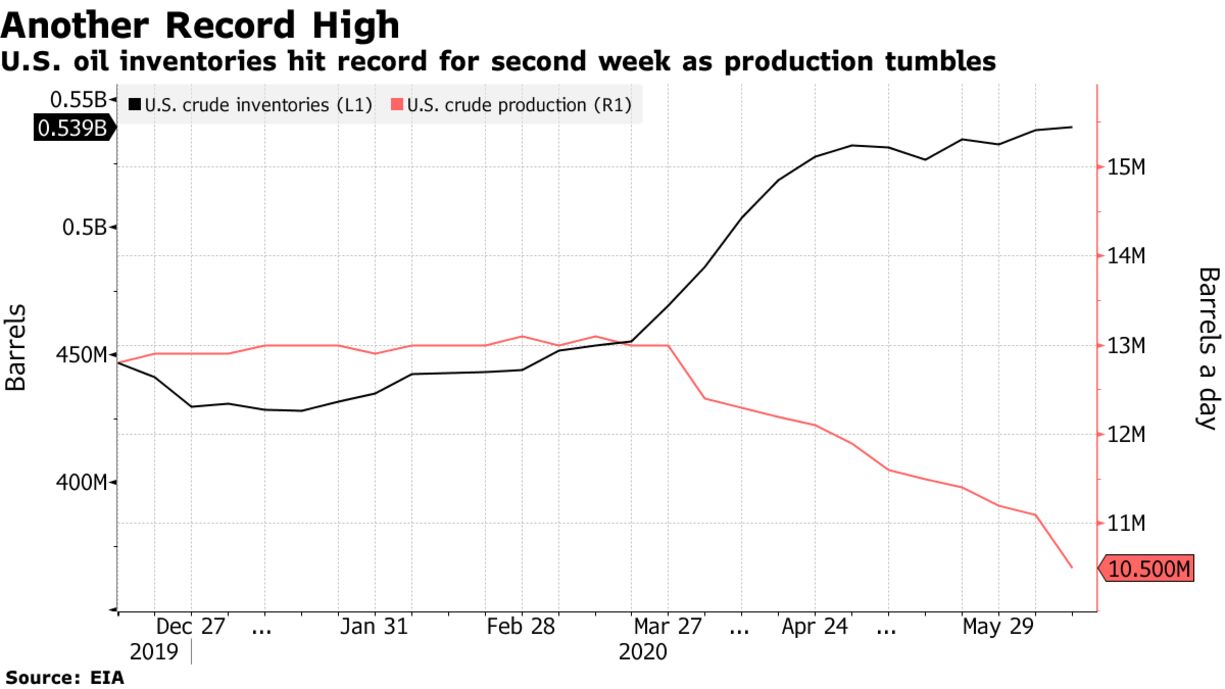

Oil slid after U.S. petroleum inventories climbed to a record for the second week in a row, more than offsetting signs of a recovery in fuel demand. Gasoline and distillate inventories fell last week, according to a report from the Energy Information Administration, reflecting a slight pick-up in demand during the summer driving season with coronavirus-led lockdowns easing in some parts of the U.S. Stubbornly high crude inventories still threaten to cap crude’s rally from historic lows in April.

“The distillate draw is a clear sign of the reopening of the economy and transportation returning,” said Rob Thummel, portfolio manager at Tortoise. “We still need to see inventories come down. That’ll be the catalyst for oil prices to move higher.”

| PRICES |

|---|

|

In a note on Wednesday, Toronto Dominion Bank’s commodity strategist head Bart Melek said “a sustained re-balancing will require ongoing demand growth, which could be challenged by waves of new infections across much of southern USA.”