An oil trade that made its way into Donald Trump’s press briefings — and earned big profits for commodity merchants and tanker owners alike — is fading away with every dollar that the price of crude rallies.

“For now, this play is largely over,” said Richard Matthews, an analyst who monitors the trade at E.A. Gibson Shipbrokers Ltd. “Quite simply the contango is no longer there, so it does not make any economic sense to enter into a new floating storage trade, unless the deal was locked in when the contango was sufficient to cover freight costs.”

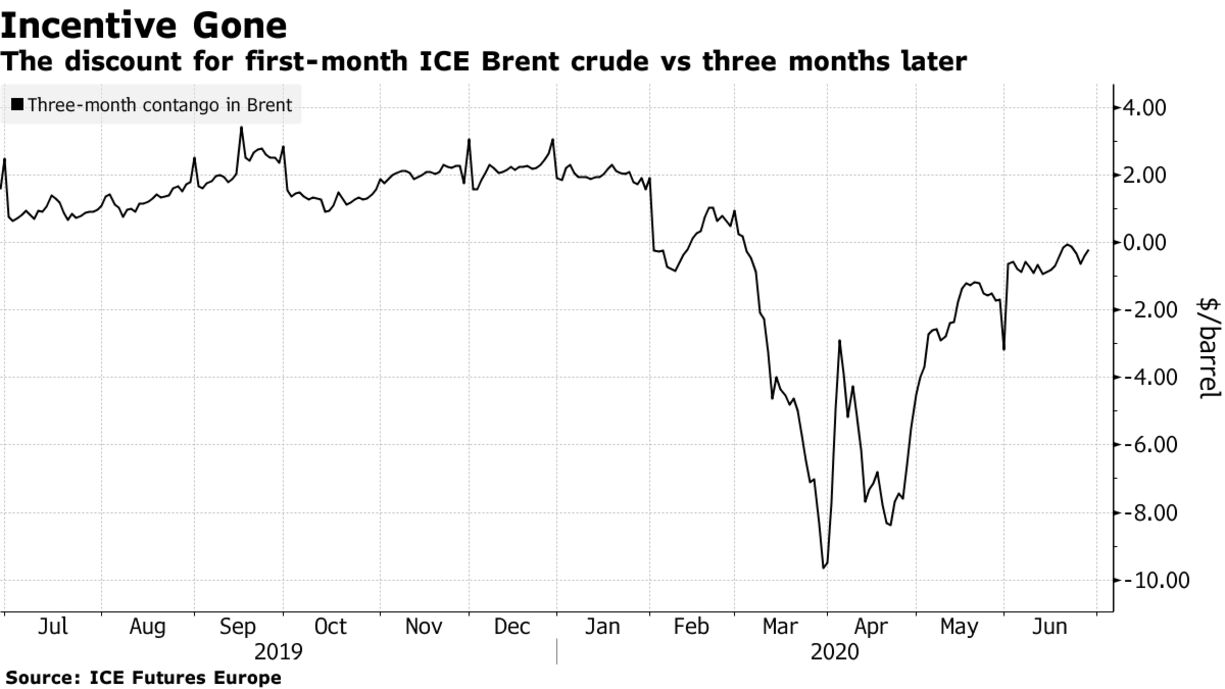

Crude oil can effectively be bought and sold months, even years, in the future. When demand crashed in March and April as cities across the world entered lockdowns and halted their transport systems, the most-immediate cargo prices slumped to deep discounts relative to later ones. That is the structure known as contango. If they could store the oil cheaply enough, and sell it later when prices were higher, then traders could make several dollars per barrel of profit.