Oil held near $42 a barrel in London as investors weighed signs of rebounding demand against a resurgence in new coronavirus cases. A rise in coronavirus cases in Germany and the recent jump in China are underpinning the difficulty for oil consumption to return to levels seen before the pandemic. Still, OPEC and its allies are on track to rebalance the oil market and there are encouraging signs of recovery, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman told an OPEC+ meeting last week.

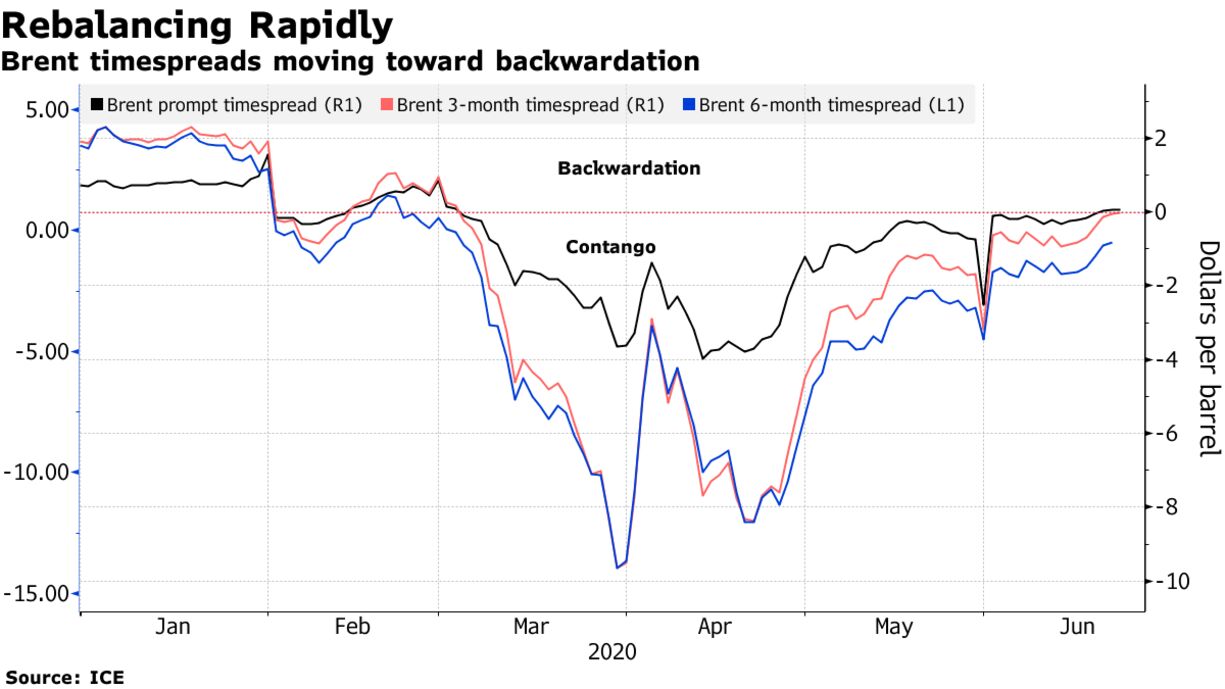

The oil market has shown signs of renewed strength in recent days. Its structure has rallied and traders have said demand is recovering rapidly following the easing of lockdown restrictions. India, one of the world’s largest consumers, said it has filled its strategic reserves to capacity. Still, in a reminder of the glut the oil market has to clear, the amount of crude stored at sea jumped last week, according to Vortexa.

“Oil prices have already reached an interim stage of recovery,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy AS. Crude reaching $45 to $50 a barrel “would not be justified at this stage despite the supply curtailments as there are still valid concerns on the demand side,” he said.