Oil hovered near $38 a barrel as investors weighed the International Energy Agency’s projection that consumption won’t fully recover until at least 2022 against economic stimulus in the U.S. and tighter physical supplies.

Those concerns are being partly assuaged by evidence OPEC+ members are complying with extended production curbs. Saudi Arabia cut term supplies to some Asian refiners by as much as 40% and Iraq said it will make deep reductions. The U.S. Federal Reserve, meanwhile, said it would start buying a broad portfolio of corporate bonds, aiding sentiment across financial markets.

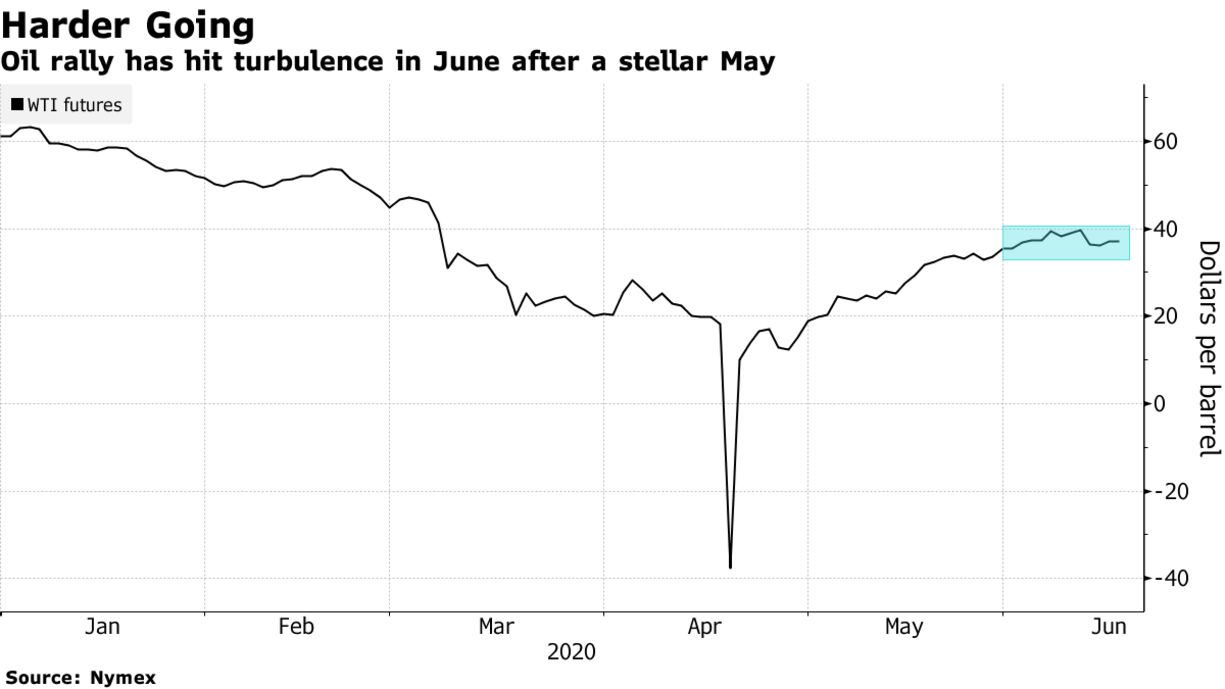

Crude has rebounded rapidly from its plunge below zero in April as the OPEC+ production cuts kicked in and U.S. production fell. While the rally fizzled out last week as second-wave concerns surfaced, physical crude markets in Europe have continued to strengthen. A White House plan to spend nearly $1 trillion on infrastructure could be positive for prices if it materializes.

“You had the Fed statement on bonds that supported the equity market and that also gave some support to the oil market,” said Olivier Jakob, managing director at Petromatrix GmbH. The general direction of the IEA’s 2021 demand numbers “was expected but at least it gives some numbers to start discussing.”

| PRICES: |

|---|

|