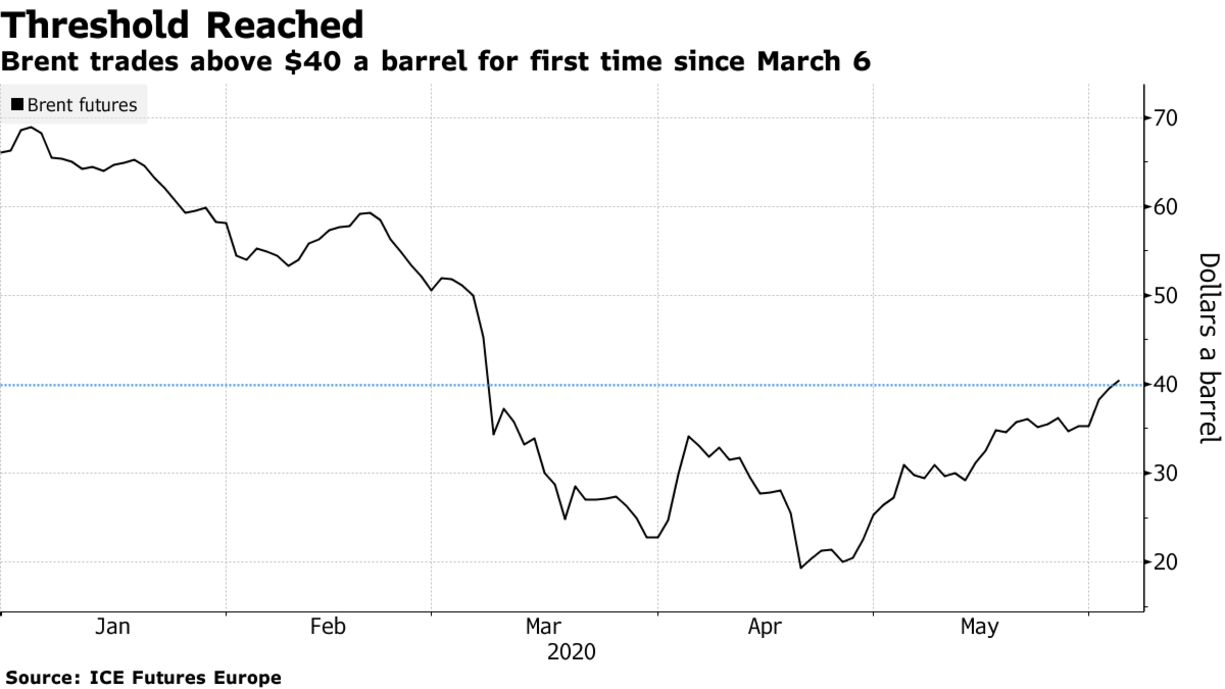

Brent oil rose above $40 a barrel for the first time in almost three months on signs that OPEC+ producers are close to agreeing on a short extension of their historic deal to cut output. Futures in London climbed around 2% after closing at their highest level since March 6, the day the OPEC+ alliance broke down. Russia and several other nations in the group favor extending the production cuts that are set to ease from July by one month, according to people familiar with the situation. That’s within the range of Saudi Arabia’s call for a one to three-month elongation.

In more evidence the oil market is rebalancing, the American Petroleum Institute reported that stockpiles at the storage hub at Cushing, Oklahoma fell by 2.2 million barrels last week. That would mark the fourth straight weekly decline if confirmed by U.S. government data due later on Wednesday.

While the global benchmark crude has now doubled from its low in mid-April, the path back to pre-virus levels of oil demand still looks uncertain. The civil strife rocking the U.S. increases the risk of a second wave of infections there, while international travel could be impacted for years to come. The rally may also be blunted by the return of American shale production.