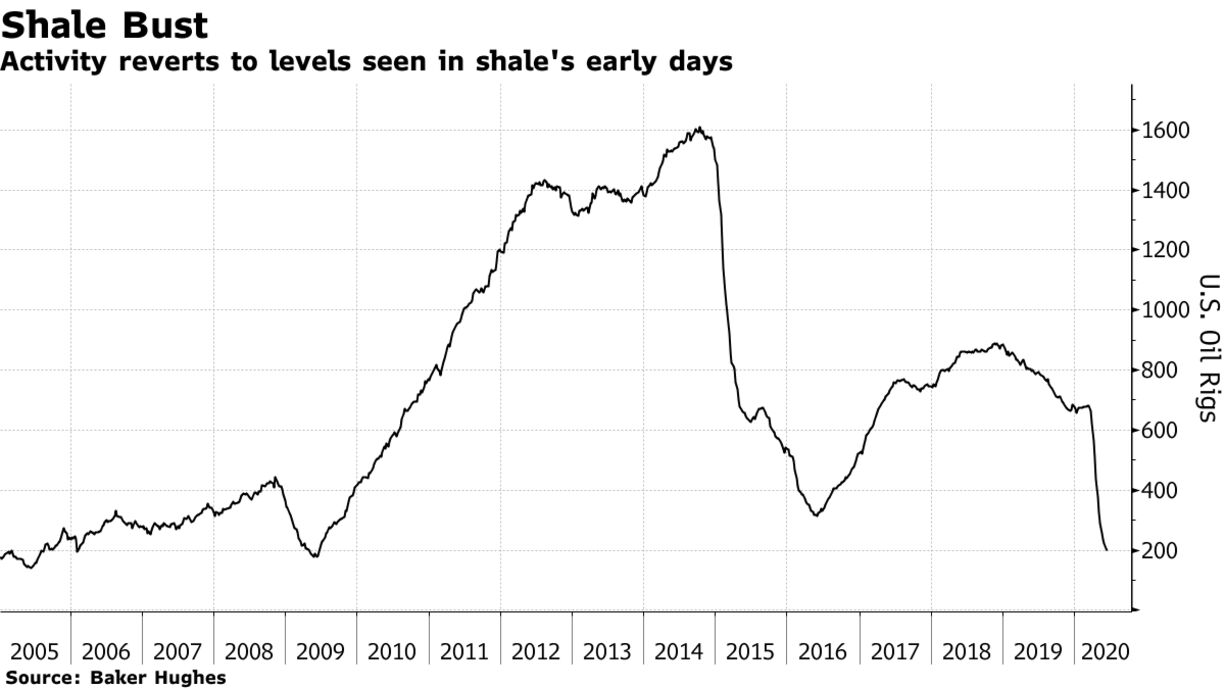

Explorers slashed drilling in the world’s biggest shale patch for a 13th straight week as they wrangle with a global pandemic that’s crimping demand for crude and leaving many strapped for cash. The number of active drilling rigs in the Permian Basin of West Texas and New Mexico fell by 4 to 137, just 3 above a record low in 2016, according to Baker Hughes Co. data released on Friday. Across the U.S., explorers idled 7 oil rigs, bringing the total to 199.

Worldwide lockdowns to prevent the spread of Covid-19 had a devastating impact on crude demand at a time when shale explorers were already struggling to generate enough free cash flow to meet their hefty debt loads. While benchmark U.S. oil futures have rebounded to more that $35 a barrel from their plunge to minus $40 in April, prices are still down 40% for the year.

“As the impact will be more severe than in the previous downturn, companies are fiercely defending shareholder value and pivoting towards more conservative spending strategies in the near-term,” Olga Savenkova, an analyst at Rystad, said this week in a report. “As the global upstream sector contends with low prices, falling demand, and fluctuating exchange rates, every dollar cut will strike directly to the bone.”

U.S. oil production has fallen 15% since early March to 11.1 million barrels a day, according to the Energy Information Administration. That’s the lowest since October 2018, when American crude futures were above $65.