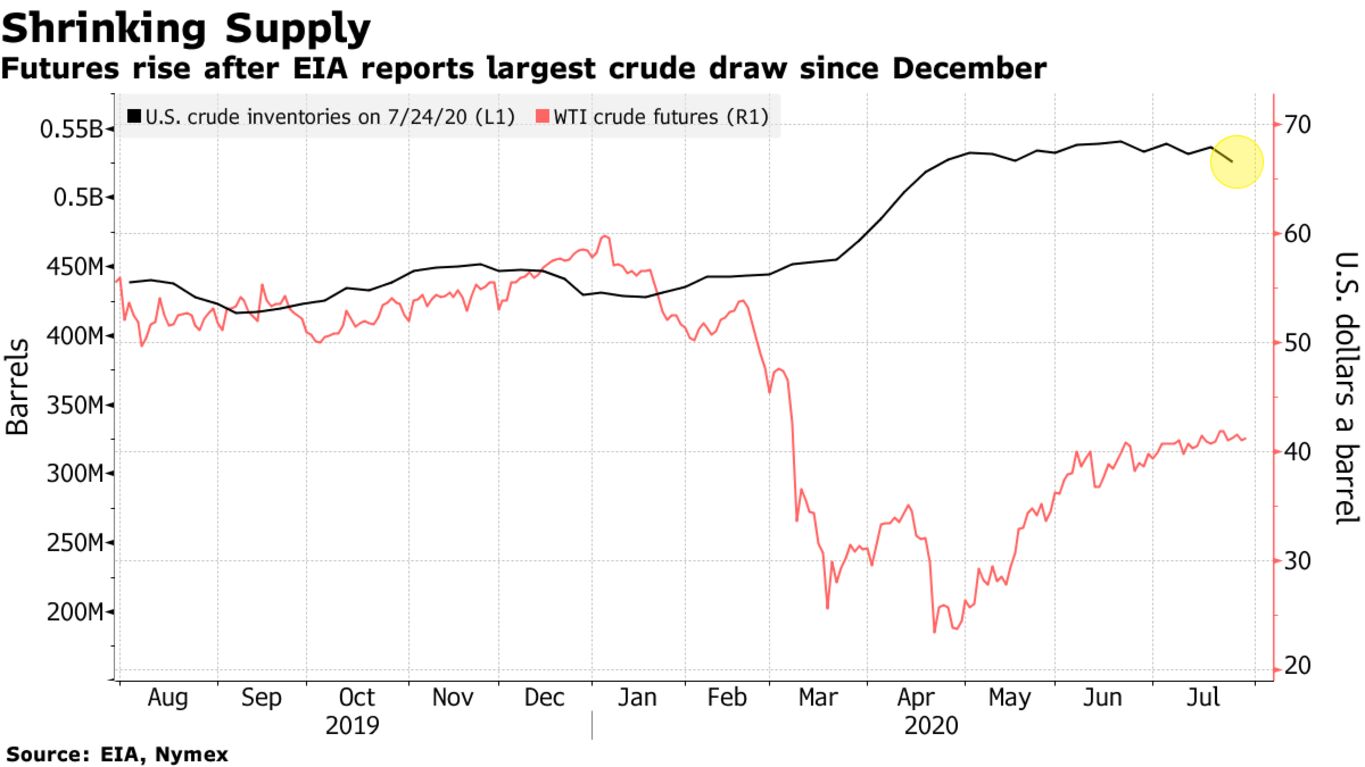

Oil held gains in Asia following the biggest drop in American crude stockpiles this year and as the Federal Reserve reaffirmed that it would do whatever it takes to shore up the U.S. economy in the face of the pandemic. Futures in New York traded near $41 a barrel after rising 0.6% on Wednesday. U.S. inventories fell by 10.6 million barrels last week, compared with analyst expectations for a gain, Energy Information Administration data showed. The optimism was tempered, however, by growing gluts of gasoline and distillates, suggesting demand is still weak during the summer driving season.

Oil is on track to post its third straight monthly advance, but gains have been slowing and August looks set to be more challenging with the virus still running rampant and OPEC+ poised to start bringing back supply. Saudi Arabia is expected to cut its official prices to Asian customers for the first time in four months, according to a Bloomberg survey, amid faltering demand.

“It’s a period of very low volatility when people are very unsure about what’s going to happen next,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. That’s why crude is trading in such a tight range and “it’s hard to see any deviation from the current environment right now,” he said.

| PRICES |

|---|

|