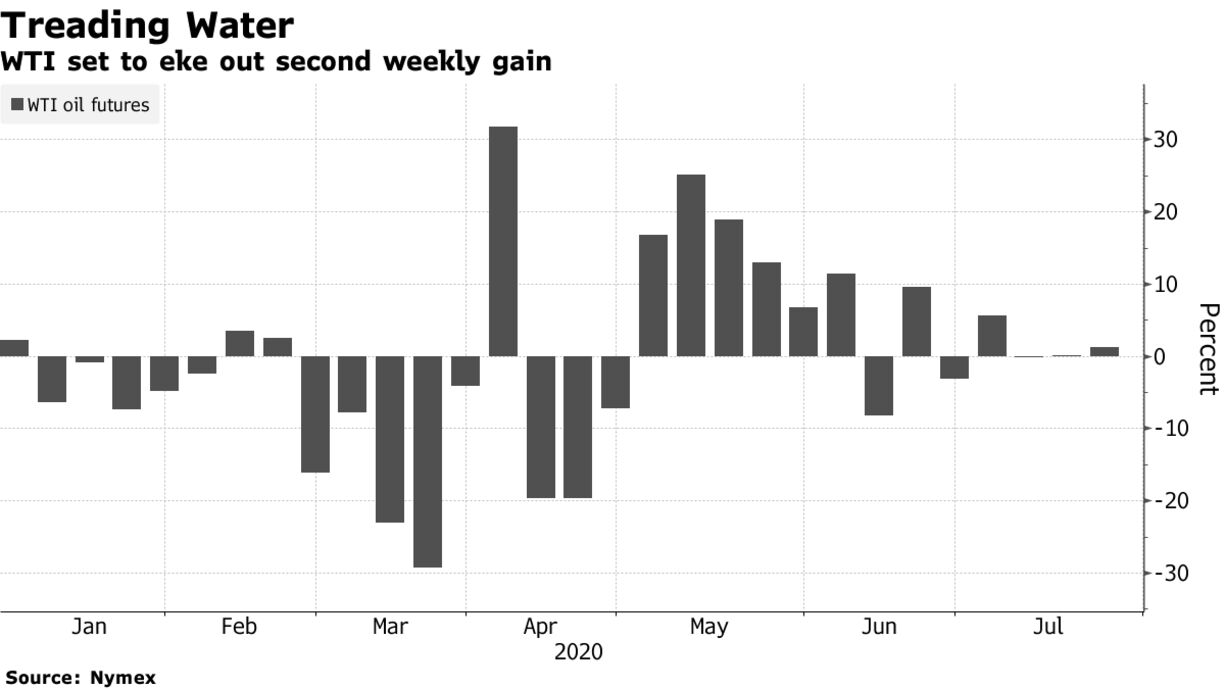

Oil swung between gains and losses as deteriorating U.S.-China relations cast doubt over the strength of the demand recovery, but European economic data showed a return to growth. U.S. crude futures rose 0.9%, poised to eke out a second weekly gain as the news of euro-area growth added to confidence already buoyed by stimulus measures agreed Tuesday. Yet strained U.S.-China ties continued to cloud the outlook, with Beijing ordering America to close its consulate in Chengdu.

Oil’s recovery from its plunge below zero has stalled, with futures stuck in a tight range since the end of June as rising coronavirus infections across major economies raise doubts that demand can rebound swiftly. U.S. crude stockpiles are climbing, Chinese consumption is cooling and swaths of India’s refining sector are offline, adding to the bearish headwinds.

“It is basically a very fragile situation,” Equinor ASA Chief Executive Officer Eldar Saetre said in a Bloomberg Television interview. “The only thing that can support a balanced market going forward is the demand picking up, and it eventually will, but the shape and form of that pickup and what it will look like is highly uncertain.”

| PRICES |

|---|

|