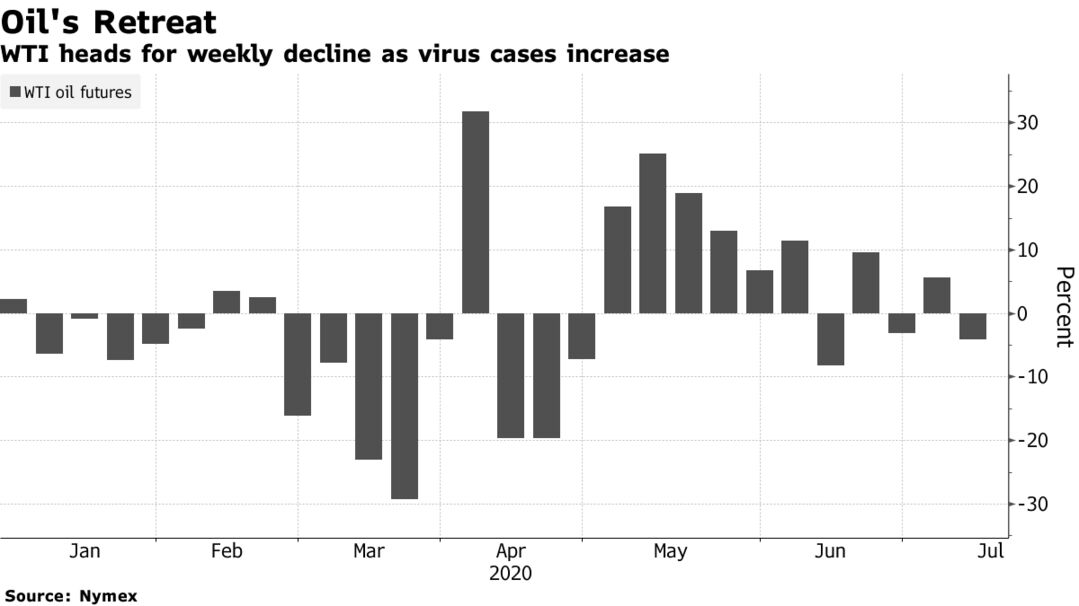

Oil fell as the International Energy Agency said a jump in Covid-19 cases could derail the market recovery, while Libya signaled the potential restart of crude exports. Futures slipped below $39 a barrel in New York, and are down 4.7% this week. The IEA said the demand recovery is at risk from a resurgence in virus cases across major economies, which has prompted tighter restrictions to curb the outbreaks. In Libya, the national oil company announced it would lift force majeure on all exports following months of near-zero shipments.

Crude dropped by more than a dollar on Thursday as the market weighed the impact of the spread of virus cases. California, Texas and Florida have recorded some of their biggest daily gains in cases and deaths this week, with the outbreak impeding efforts to reopen the economy at a time when companies are cutting costs wherever they can. That’s helped push some market gauges down to their weakest levels in almost a month.

| PRICES |

|---|

|