Oil fell on signs that the recovery in oil consumption may be starting to slow. Futures in New York fell below $41 a barrel after struggling to surpass their highs from June in recent days. Indian road fuel sales fell in the first half of July as localized virus lockdowns occurred in several cites, and the Chinese city of Urumqi locked down some areas amid fears of another outbreak in the country. American unemployment figures barely dropped last week, highlighting the risks to a broader economic recovery.

Though demand concerns are returning in some of the world’s largest consuming regions, it remains a far from uniform picture. Japan’s fuel demand is just 4% lower than a year earlier, and there have been steady recoveries in nationwide consumption in the U.K. and the U.S.

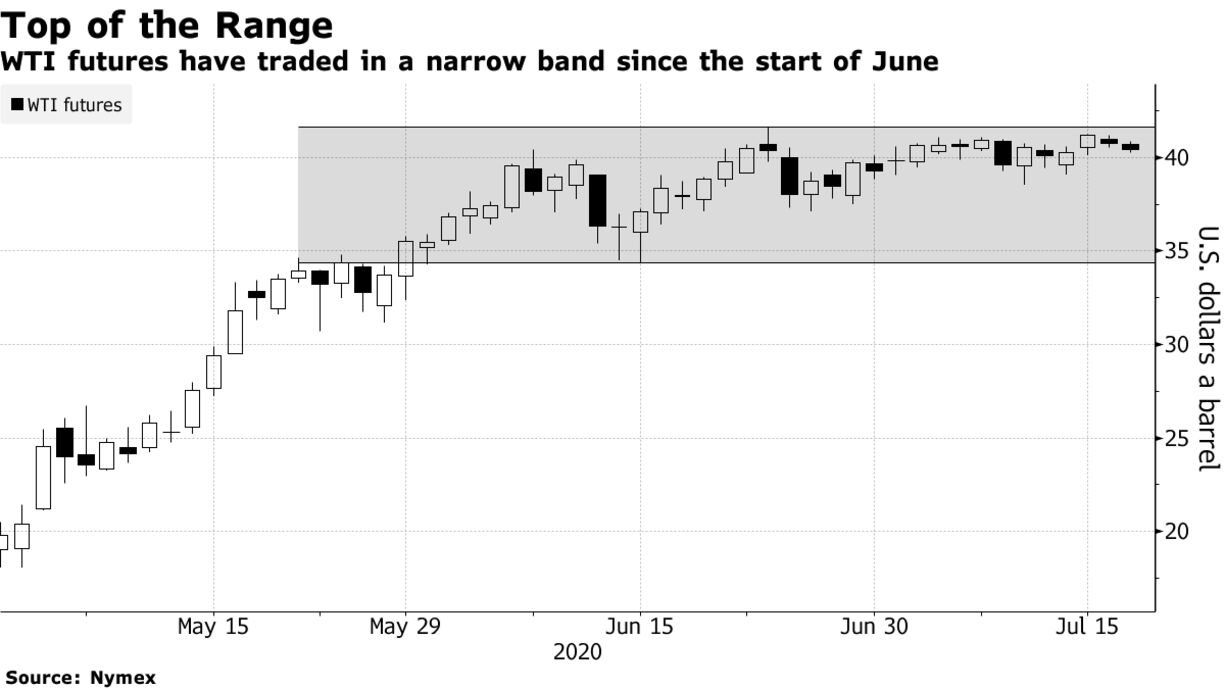

After rebounding rapidly from its nadir in April on supply cuts and returning demand, crude has traded in a narrow range since early June and has run into technical hurdles at its high for that month. OPEC+ said it would start tapering output cuts from next month, though there are signs that additional output from Saudi Arabia and Russia will be consumed domestically.

“Whatever OPEC+ does could be futile if the needed demand doesn’t follow,” said Louise Dickson, oil markets analyst at consultant Rystad Energy A/S. “As traders come to realize that road fuel demand is in danger, prices naturally took a small hit today.”

| PRICES: |

|---|

|