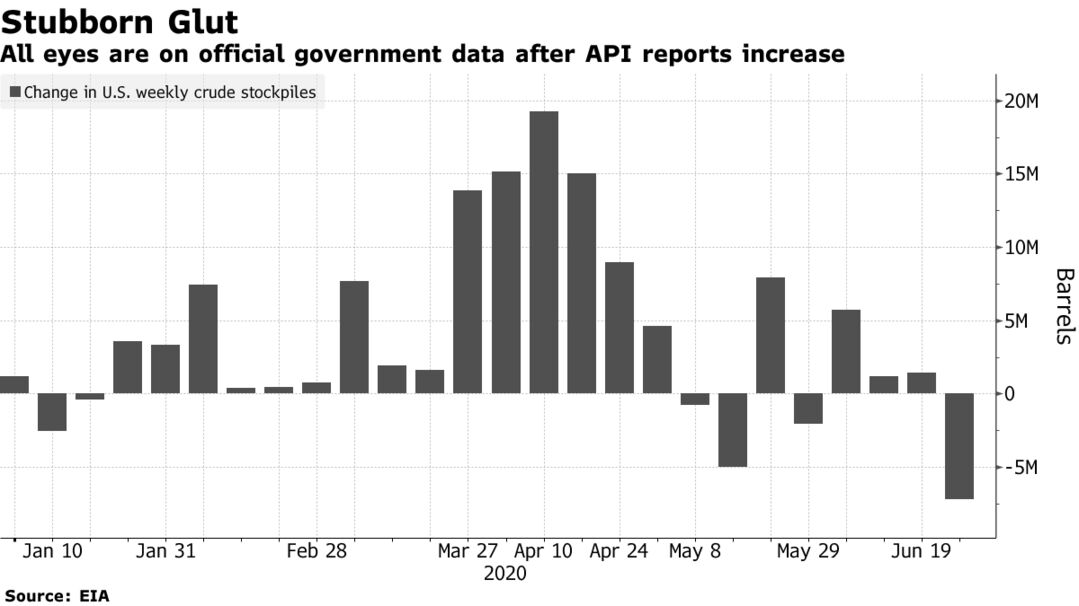

Oil was anchored below $41 a barrel with an industry report signaling a surprise gain in U.S. crude stockpiles, while concerns linger about the threat to demand from rising coronavirus infections. The American Petroleum Institute reported inventories rose by 2.05 million barrels last week, before government data Wednesday. The virus is setting records across the U.S., with Texas’s daily cases, Arizona’s deaths and hospitalizations in California hitting new highs.

Crude has been steady this week as traders weigh the reintroduction of virus-control measures on the one hand and stimulus by many governments to bolster their economies on the other. Oil market volatility has tumbled and trading volumes have fallen by about a third since the start of this month. Prices have been supported by OPEC+’s record output cuts so far, but those are scheduled to be eased starting next month. Oil is stuck “until it is given a convincing reason to move in either direction,” said Louise Dickson, an analyst at Rystad Energy A/S.

| PRICES |

|---|

|

Virus cases in the U.S. rose 1.8% from a day earlier to 2.96 million, according to data compiled by Johns Hopkins University and Bloomberg News. European officials warned that the impact of the pandemic may be worse than previously estimated and that the recovery may take longer because of a slow easing of restrictions.