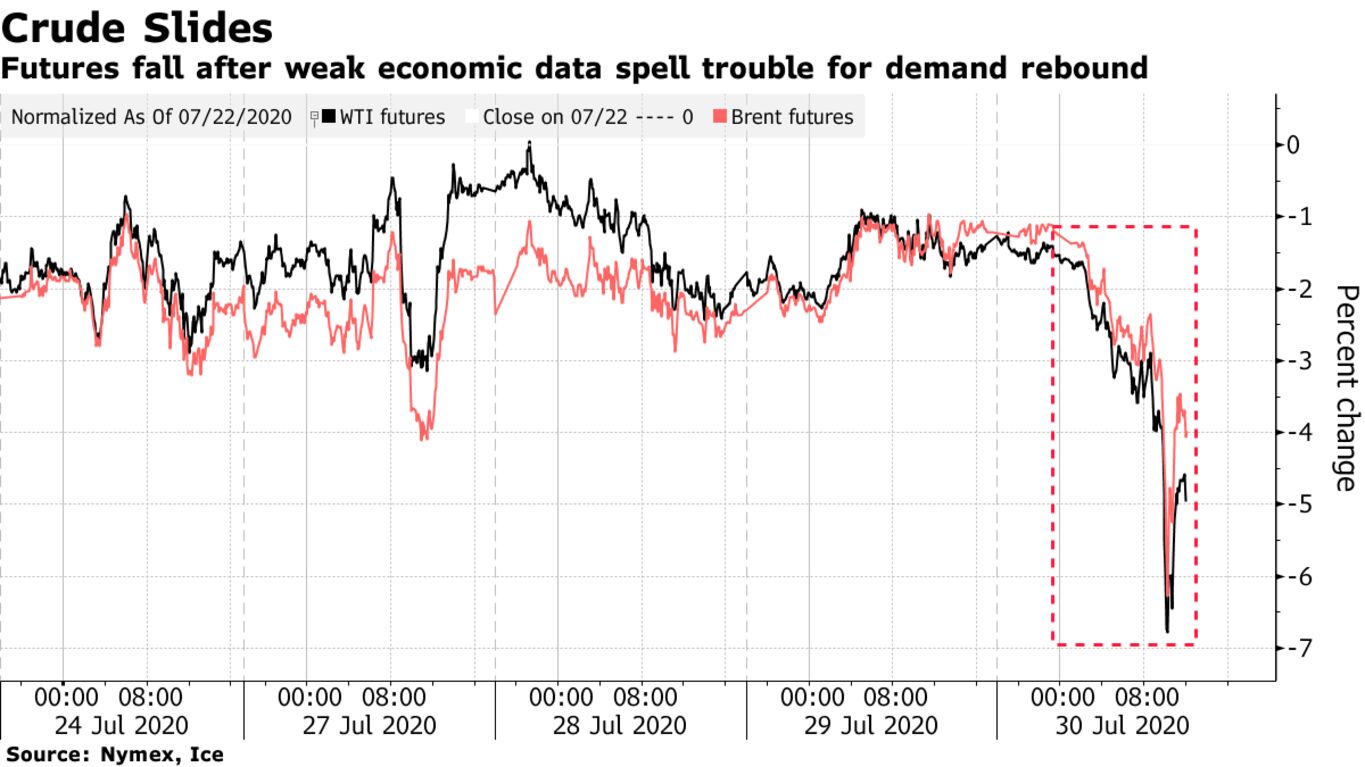

Oil cratered the most in more than a month after data showed the U.S. economy had its worst contraction on record, with demand expected to languish as millions of Americans remain out of work. U.S. benchmark crude futures tumbled 3.3%, closing at the lowest level in three weeks. Equities in the U.S., Europe and Asia weakened, with the S&P 500 Index spiraling lower by as much as 1.7%.

“The slew of very worrying economic data overnight and this morning is really weighing on the complex,” said John Kilduff, a partner at Again Capital LLC. The gross domestic product declines in Germany and the U.S. “does not bode well for gasoline demand.”

Futures in New York have been trading around $40 a barrel since early June with market volatility depressed as a resurgent coronavirus pandemic continues to sour the outlook for a steady demand recovery. Royal Dutch Shell Plc Chief Executive Officer Ben van Beurden said oil demand may not see a full recovery until next year.

On the supply side, OPEC+ alliance is days away from unleashing crude back onto the market following historic output cuts, and in the U.S., ConocoPhillips is the latest explorer to announce it’s bringing back oil production as prices climb from historic lows back in April. Shale producers Continental Resources Inc., Parsley Energy Inc. and EOG Resources Inc. have said they would restore some curtailed output in July.

| PRICES |

|---|

|