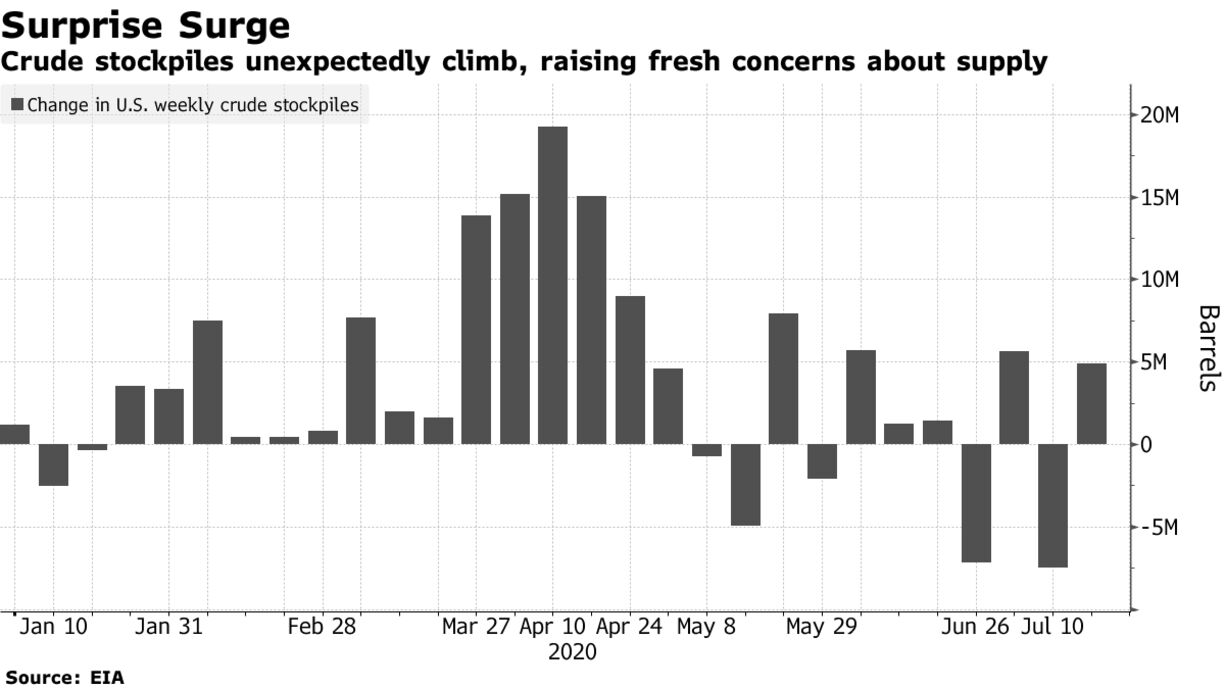

Oil rose toward $45 a barrel in London, with a weaker dollar and stronger equity markets countering an expansion in U.S. crude stockpiles. Brent futures traded near their highest level since March as European stocks and U.S. equity futures advanced. Yet bearish signs persist in the physical market. China’s thawing oil demand has seen the value of Iraqi crude drop, and there’s renewed weakness in the key swaps that help value North Sea grades. In America, crude stockpiles rose by 5 million barrels last week.

Oil jumped earlier this week after European Union leaders agreed on a stimulus package, but prices have struggled to break out of a tight range this month. While the race for a coronavirus vaccine is gathering pace, rising infections across major economies and the imminent easing of OPEC+ output cuts is keeping a lid on further price gains amid a patchy recovery in consumption. “Uncertainty comes from demand,” said Tamas Varga, an analyst at PVM Oil Associates. “It is imperative to follow the dollar exchange rate, as a layer of oil-demand support will disappear should the greenback start strengthening again.”

| PRICES |

|---|

|