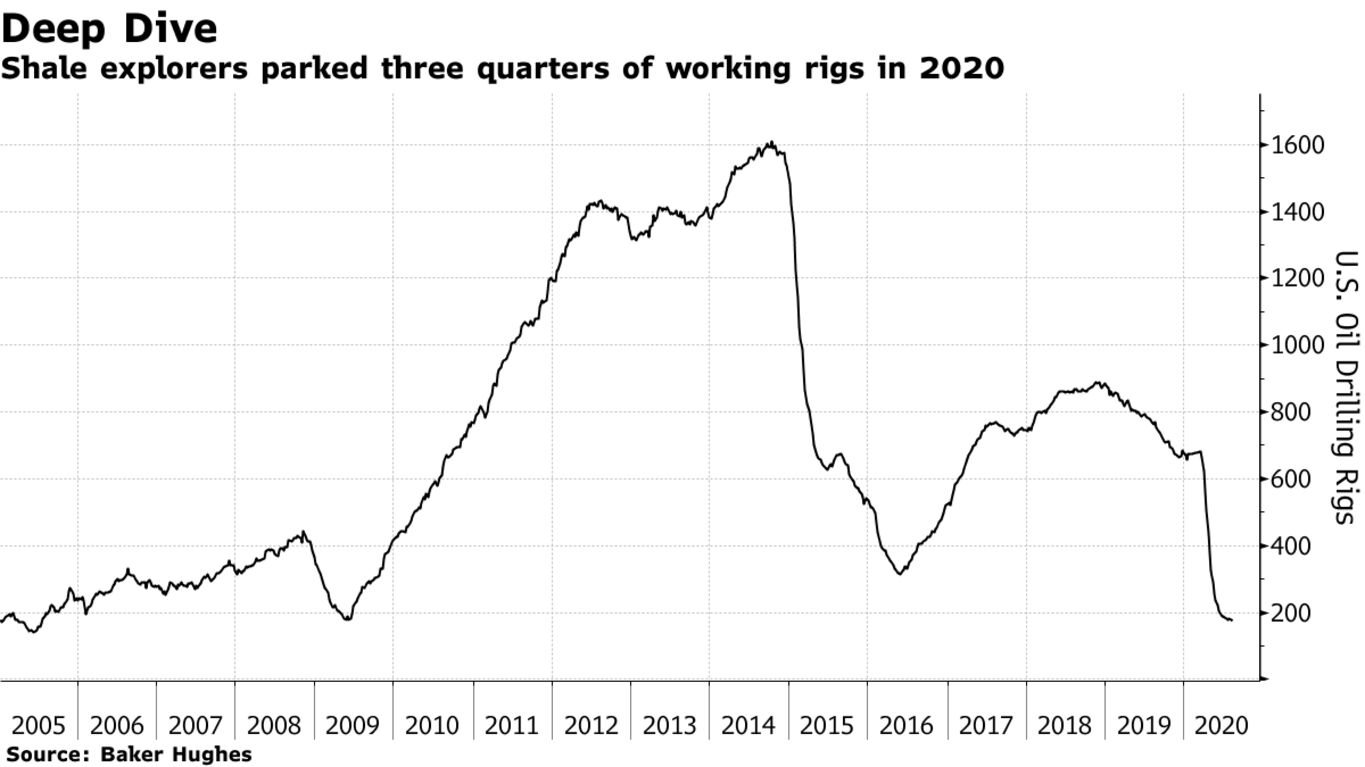

Drillers cut exploration in U.S. oil fields to a 15-year low as billions of barrels from old discoveries became worthless and explorers abandoned growth plans. The number of active oil rigs in the U.S. fell by four to 176, the lowest since 2005, according to Baker Hughes Co. data released Friday. Energy companies have been parking rigs on an almost uninterrupted streak for more than four and half months.

Instead of searching for new untapped deposits of crude, oil executives are channeling cash into dividends and other shareholder-friendly initiatives to appease investors fed up with years of poor returns.

“North American E&Ps are in a battle for investment relevance, not a battle for global market share,” Matt Gallagher, chief executive officer at Parsley Energy Inc., told analysts during a conference call. “Allocating growth capital into a global market with artificially constrained supply is a trap our industry has fallen into time and time again.”

Permian Decline

Most of the weekly rig decline occurred in the Permian Basin, North America’s biggest oil field, the data showed. Drilling also dropped in the Eagle Ford Shale in South Texas and stagnated in the Bakken and Denver-Julesburg regions in North Dakota and Colorado, respectively.

The rig count is a closely watched metric because it’s long been considered indicative of future crude production. The relationship is imperfect, however, because of the time lag between drilling a well and commencing production, as well as other factors such as the turning off of existing wells in response to price movements.