Oil climbed to near a five-month high after an industry report pointed to a third straight weekly drop in American crude stockpiles. Futures in New York rose past $42 a barrel after losing 0.8% Tuesday. The American Petroleum Institute reported inventories fell by 4.01 million barrels last week, according to people familiar with the data. The improving picture in the U.S. overshadowed anxiety over the still-surging coronavirus. India’s oil product consumption was still down 12% compared to a year earlier in July, as the nation continues to grapple with the virus, while New Zealand’s largest city went back into lockdown.

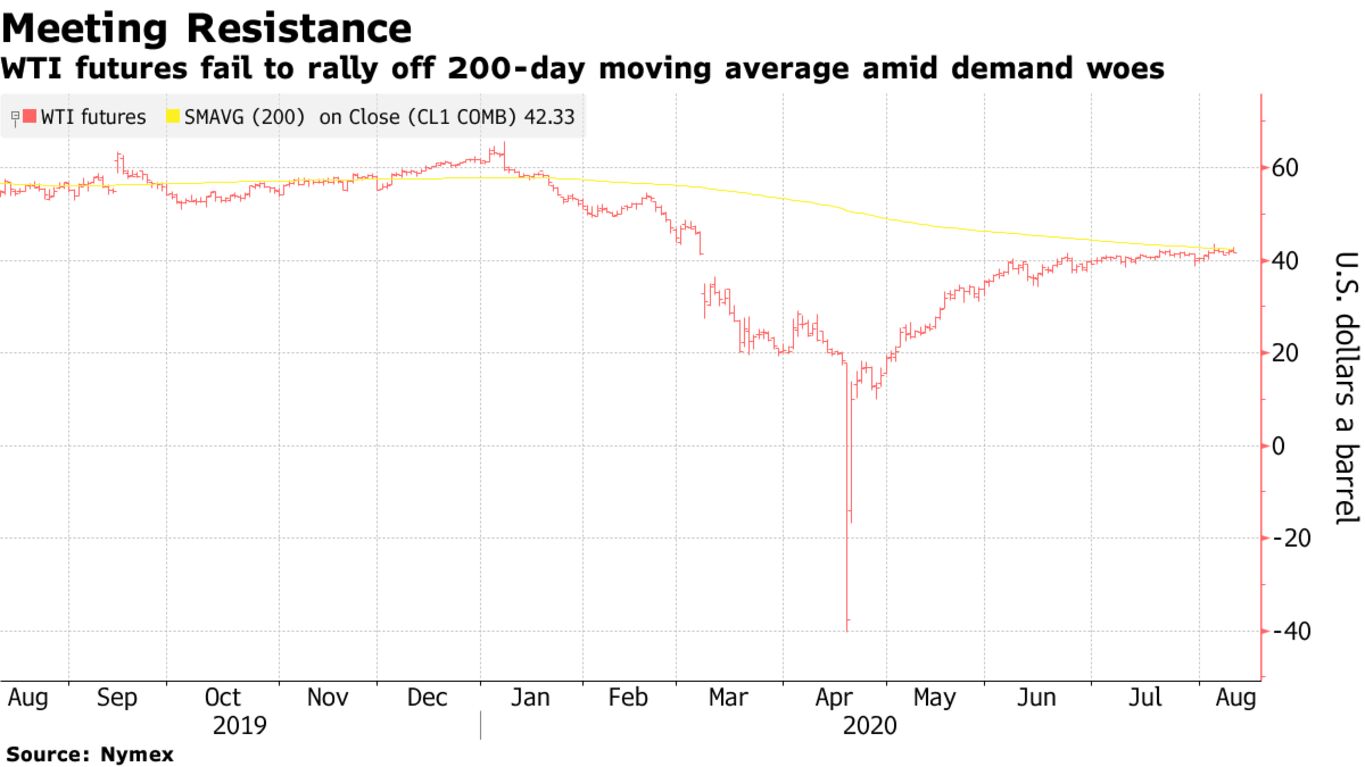

Oil has battled its 200-day moving average for the last week, with prices kept in check amid ongoing uncertainty over the trajectory of the demand recovery from the pandemic. At the same time, OPEC+ is adding barrels back to the market, though the U.S. picture is more uncertain. The Energy Information Administration revised down its production forecast for this year on Tuesday and American crude that had been stored at sea for 100 days is now sailing to Asia as demand recovers.

“Both crude markers are regaining ground amid expectations for a drop in U.S. oil inventories,” said Stephen Brennock, analyst at PVM Oil Associates Ltd. “Market players are cheering the easing U.S. oil glut but the upside will be capped by nagging fiscal uncertainty in Washington.”

| PRICES |

|---|

|

Saudi Arabia will grant the oil supply asked for by refiners next month, while also accommodating some requests for reduced volumes of its lighter grade. Some had sought to take less Arab Extra Light crude with more affordable alternatives available, including crude from the Permian.