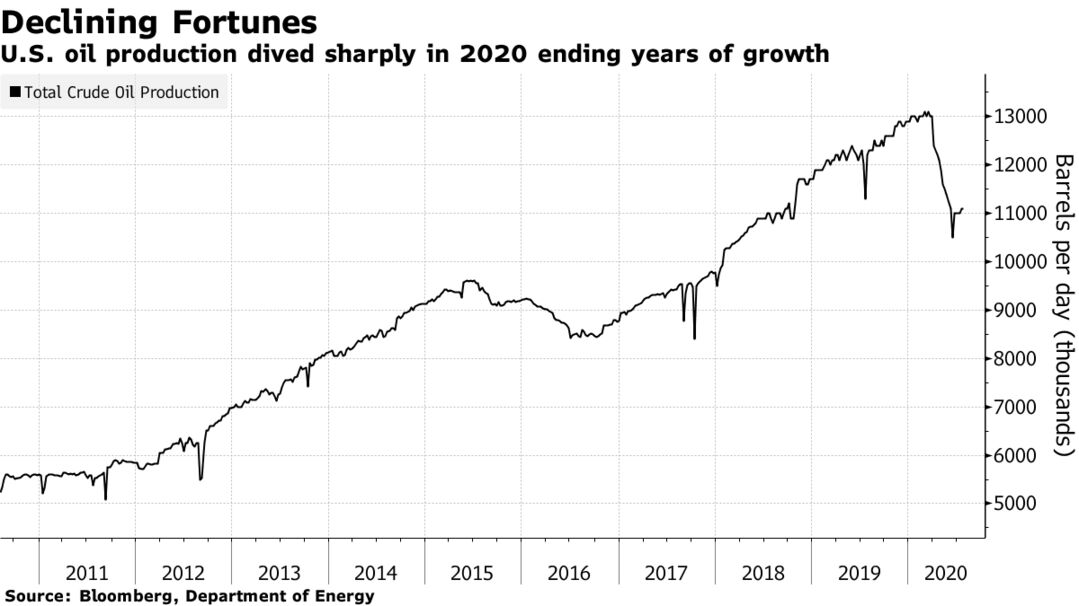

America’s most prolific shale drillers are accepting a fate once anathema to an industry obsessed with growth: Drilling just to ward off production drops. The pandemic and subsequent plunge in crude prices has forced U.S. crude explorers to scrap plans to expand supplies amid investor skepticism toward the shale business model. For some of the biggest names in the Permian, that’s meant vowing restraint as long as oil lingers at levels too poor to justify a new boom.

“These guys have all just had a near-death experience,” said Raoul LeBlanc, an analyst at IHS Markit Ltd. “It will take some time to get themselves back in a a better position.”

Management teams chastened by crude’s precipitous fall below zero earlier this year are beginning to outline 2021 spending plans. Diamondback Energy Inc. said it’ll maintain oil output at this year’s level, which is expected to be dramatically lower than 2019. Concho Resources Inc. expressed similar intent last week.