Even the cleanest fossil fuel is losing its appeal to rich nations. Just a few years ago, natural gas was hailed as vital for the transition toward an economy that runs on renewable energy. But sentiment is changing and the fuel is going the same way as coal, its dirtier sibling shunned by governments, utilities and investors. The cancellation of the giant Atlantic Coast pipeline in the U.S. and Ireland’s decision to scrap backing for an import terminal this summer are the latest signs that gas is falling out of favor with everyone from regulators to asset managers.

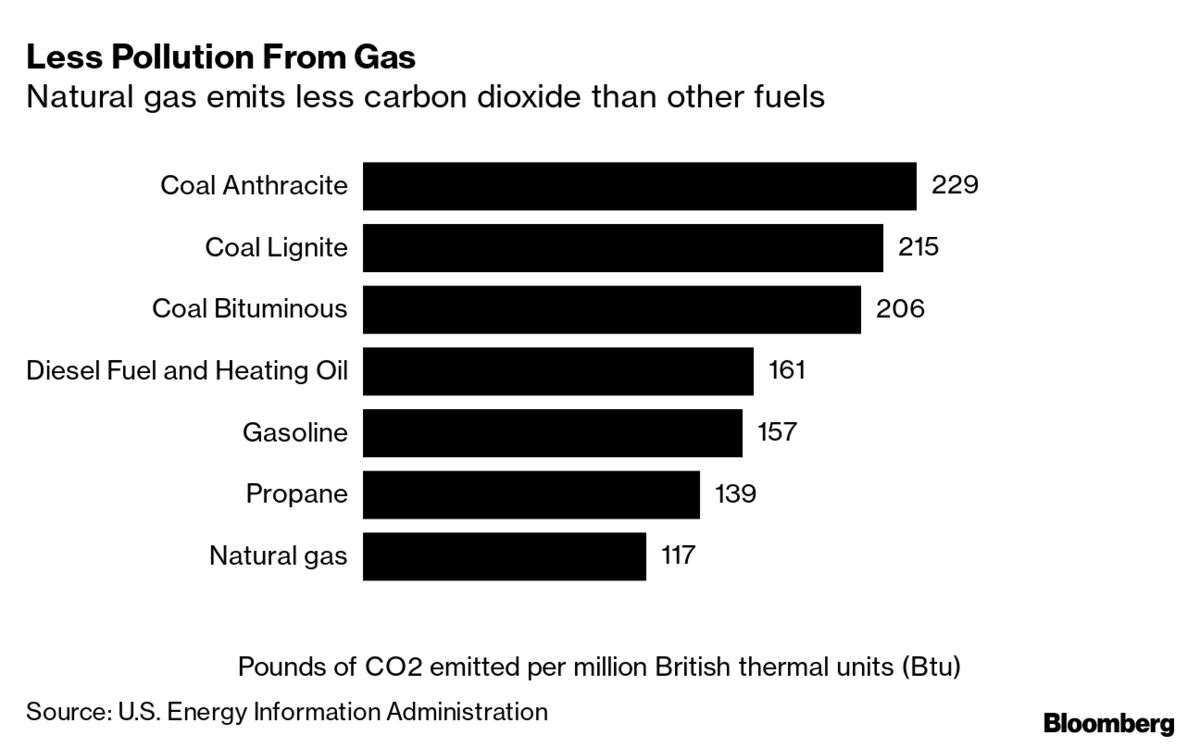

As countries intensify efforts to meet climate obligations, the fuel used for heating, cooking and power production is poised to lose out to solar, wind and private and public energy efficiency measures. While natural gas only emits about half the carbon dioxide of coal, flaring and methane leaks have tarnished its reputation across the globe, according to Nick Stansbury, head of commodity research at Legal & General Investment Management Ltd. in London. Many investors are also shying away to instead allocate funds to projects aligned with objectives of the Paris Agreement, he said.

“Gas companies have underestimated that the public opinion is changing rapidly,” said Stansbury. “Coronavirus lockdowns have had a role in that change, as investors are also stepping back and rethinking how things should be done.”