Coal prices in Europe show little sign of getting the usual uplift into the winter heating season thanks to a groundswell of rising pollution costs, cheap natural gas and high renewables output. Power demand crippled by Covid-19 has made it even more difficult for the industry to compete economically, with coal generation down 44% among seven major European utilities in the first half of 2020 as renewables output increased by 38%, according to BloombergNEF.

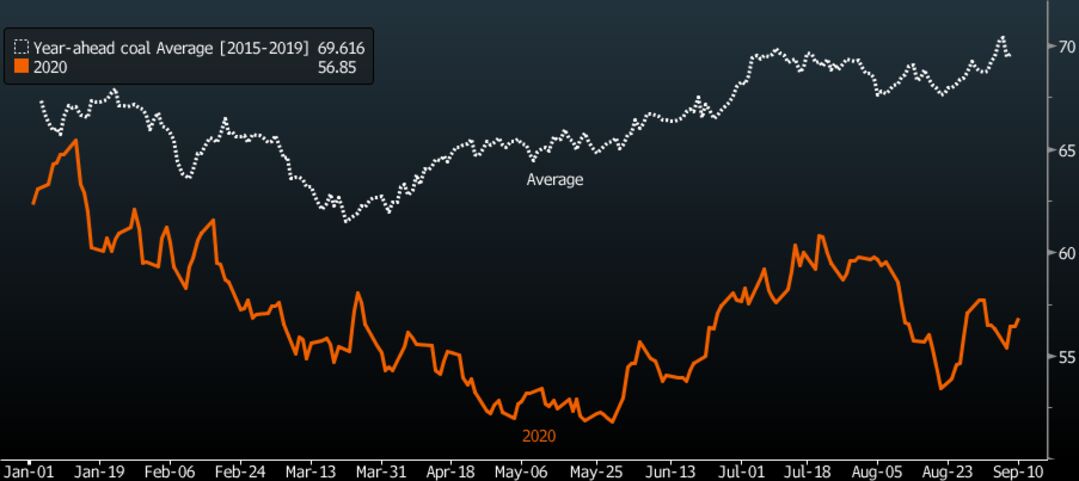

Year-ahead coal prices have almost halved since 2018 when the fuel hit $100 a ton, and could plunge to $45 by next year, according to Capital Economics Ltd. Coal futures for 2021 were trading at $57.75 a ton on ICE Futures Europe on Monday.

Year-ahead northwest Europe coal price trails 5-year average; prices $/ton ICE Futures Europe

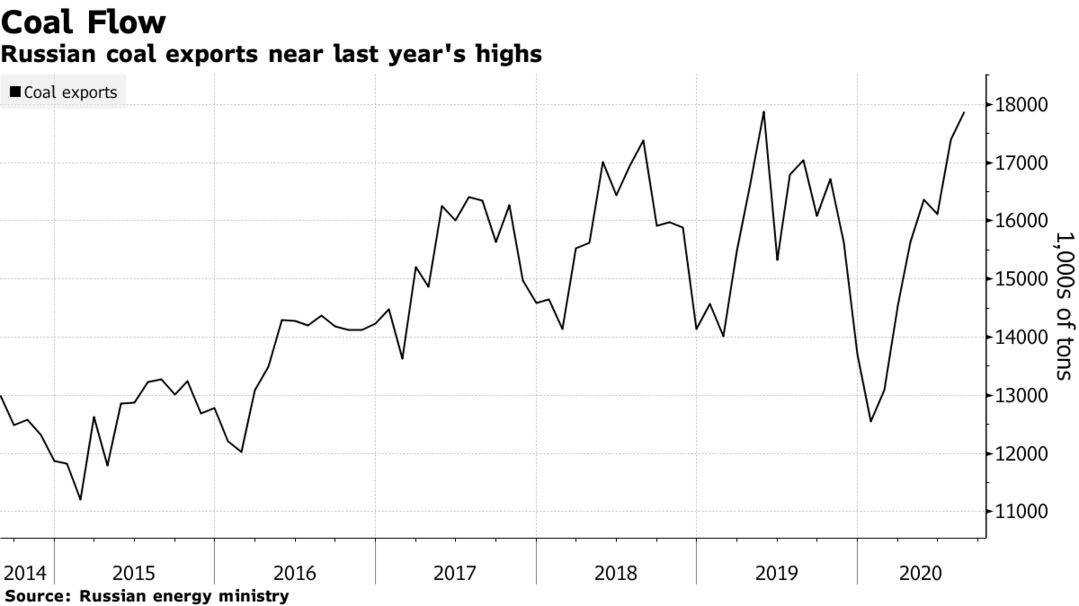

“High carbon credit prices, strong production growth in Russia and a fitful economic recovery in Europe will keep prices subdued,” said James O’Rourke, a commodities economist at Capital Economics. “We doubt that coal consumption in Europe will ever recover to pre-virus levels, as most European countries are actively investing in decarbonizing power generation.”

Coal received a boost during a heat wave in July and August that increased power consumption. But the weakest seasonal natural gas levels since 2009 and carbon-emission permit prices near record highs are expected to persistently squeeze coal out of electricity generation.

For the past year, it has been cheaper to burn gas for power than coal, according to the Bloomberg German year-ahead spark spread model.

Gas Powered

Coal plant profitability outpaced by gas-fired generators in Germany

Source: Bloomberg, broker data

*Difference between German coal and gas plant margin 1 year forward

Even so, some coal-fired power generation is showing signs of recovery following the easing of coronavirus lockdowns. German daily coal-fired power output climbed above the five-year average last week for the first time since February, European Energy Exchange AG data show.