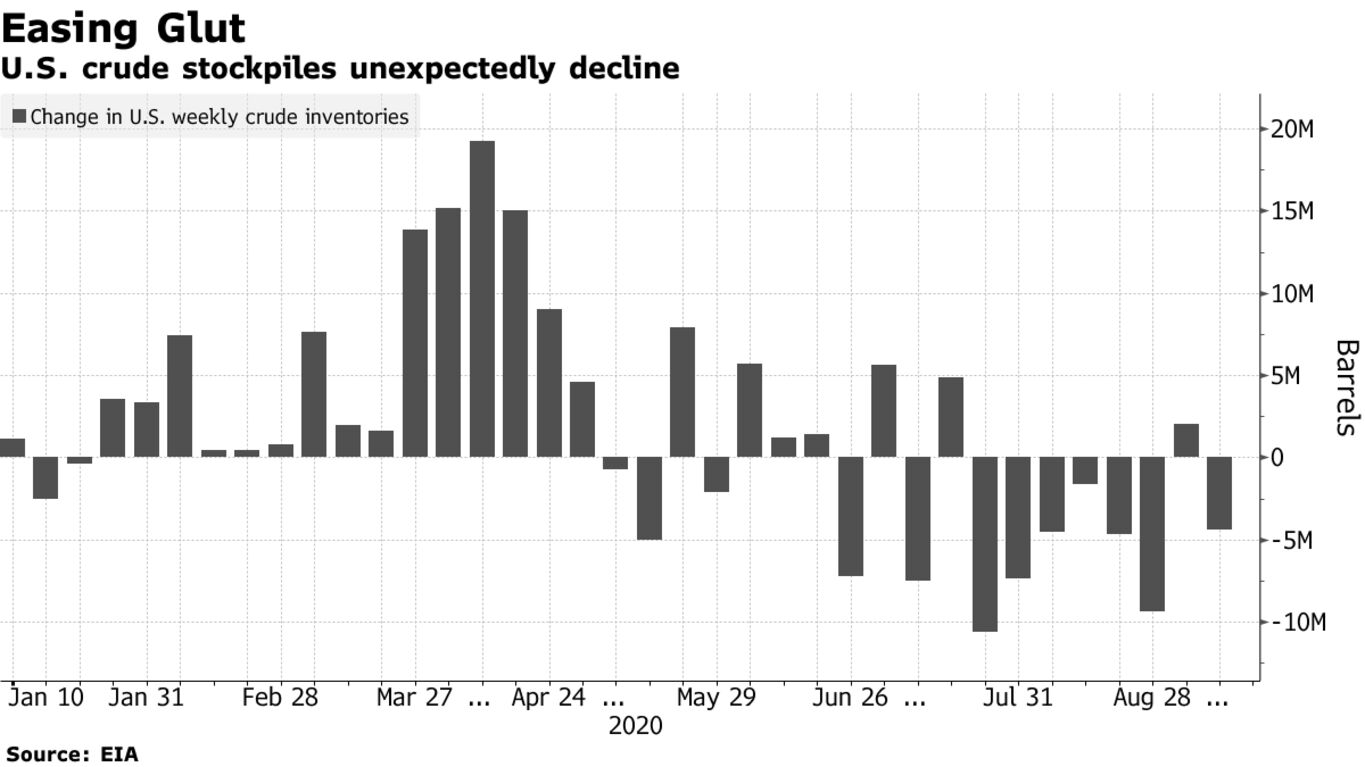

Oil dropped below $40 a barrel with a stronger dollar after the biggest surge since June following a surprise decline in U.S. crude stockpiles. Futures in New York slid 1.7% as the dollar rose, making commodities priced in the currency less appealing. Inventories fell last week to the lowest level since April, according to government data Wednesday, compared with the forecast for a gain in a Bloomberg survey. Meanwhile, the Federal Reserve signaled it would keep interest rates near zero for at least three years, although Chair Jerome Powell said he’s not sure if the robust recovery will continue.

Oil has clawed its way back to $40 a barrel this week despite bearish calls for the market from the International Energy Agency and industry players such as BP Plc and Trafigura Group. An OPEC+ committee meets Thursday to discuss if the group’s production cuts are enough to stave off a potential glut.

“Shrinking American crude stockpiles and the Fed’s gesture to aid the economic recovery have lifted prices, while a disruption to supply in the U.S. from the storm has also done its part,” Kim Kwangrae, a commodities analyst at Samsung Futures Inc., said by phone from Seoul. “But weak consumption remains a downside risk, setting oil for a rocky ride in the short term.”

| PRICES |

|---|

|