Oil dipped to its lowest level in nearly a month with a stronger dollar, looming extra supplies from Iraq and depressed demand all contributing to the bearish sentiment. U.S. benchmark crude futures dropped 0.3% on Thursday. Investors are turning more risk averse, with U.S. equities tumbling by the most in almost three months, while a stronger greenback pares demand for dollar-denominated commodities. Meanwhile, Iraq signaled it may seek an extension to implement extra output cuts as part of the OPEC+ deal.

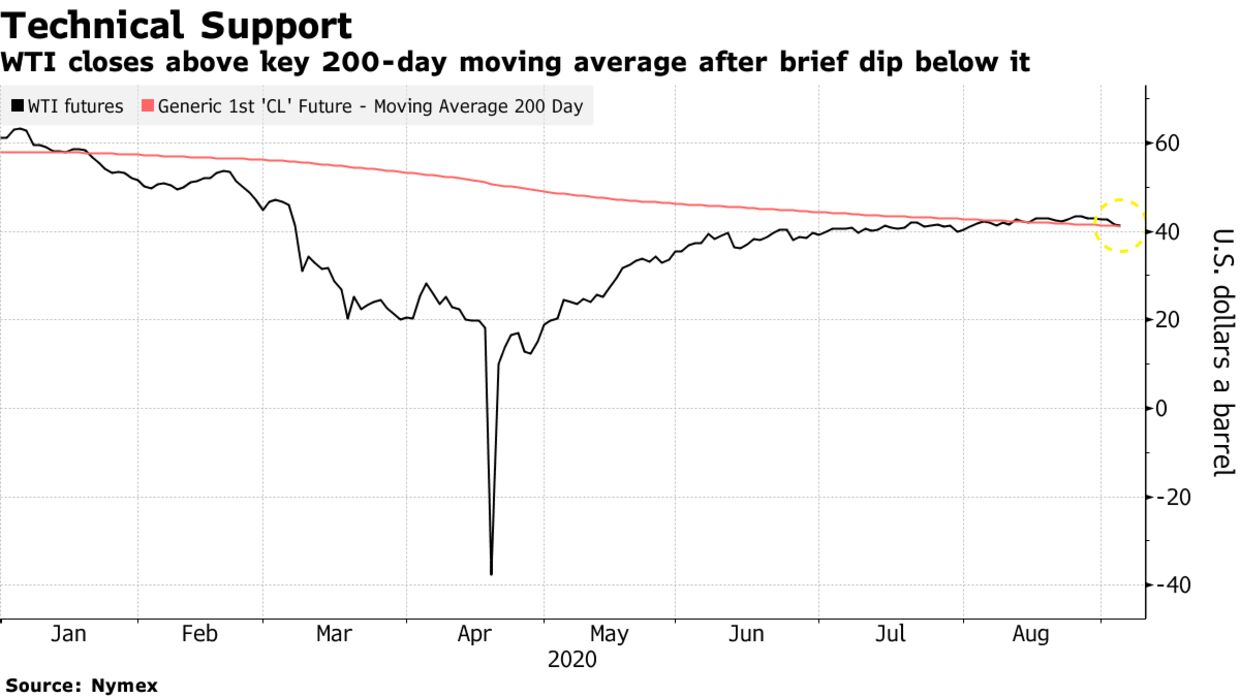

Still, futures in New York pared losses during the session and bounced off their 200-day moving average — a key technical support level — staving off the dip below $40 a barrel. Prices last closed below the psychological round number in early July.

After four straight months of rallies, U.S. benchmark crude futures are off to a weak start in September with demand seen softening further as refineries begin seasonal maintenance. The global recovery from the pandemic continues to be spotty, with some areas in the process of reopening their economies while others are facing new surges in infections. On the supply side, OPEC+ began to taper production cuts in August, with Saudi Arabia raising output by just over 400,000 barrels a day during the month.

If refining margins remain weak, there could be reason “for more extensive turnarounds this time, because the opportunity cost of being down isn’t quite as high,” said Stewart Glickman, energy equity analyst at CFRA Research. “But it’s still a wait-and-see.”