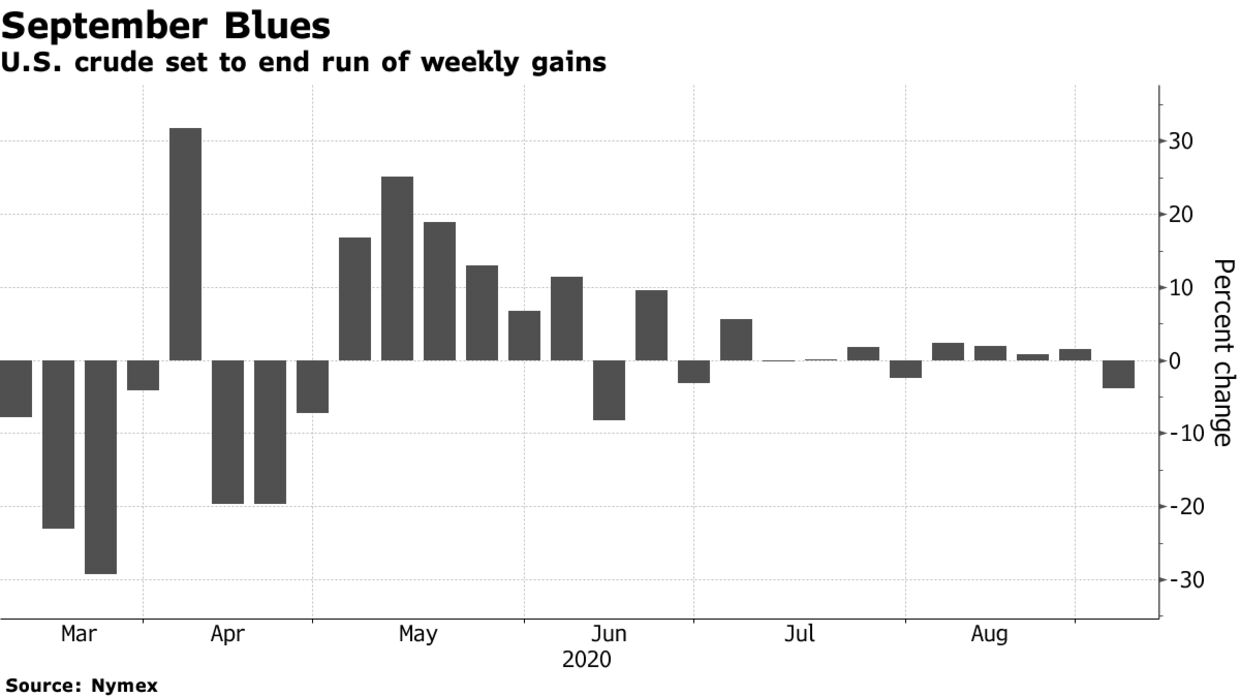

Oil erased earlier losses as the dollar’s decline makes commodities more attractive, but crude was still headed for a weekly drop over demand concerns. Futures in New York rose 0.8% while the greenback gave up gains to trade 0.2% lower. The oil market is still struggling with a slow recovery in consumption while higher supply from OPEC and its allies is starting to kick in.

Oil has got off to a weak start in September with many countries still fighting to contain the coronavirus. The market will be watching August non-farm payroll data due Friday for signs of improvement in the U.S. economy. At the same time, crude supply is likely to remain higher than expected as Iraq is struggling to meet its output commitments under the OPEC+ deal.

| PRICES |

|---|

|

The diesel market is also weighing on the overall demand outlook. The fuel’s premium to Brent, a key metric used to gauge the market’s strength, plunged to the lowest in at least nine years due to stuttering consumption and a glut of supply. Diesel, used to power heavy industry such as agriculture and mining, as well as cars and trucks, is an important marker of economic health.