Oil declined as Libya signaled the resumption of some crude exports while surging coronavirus cases cloud the outlook for demand. Futures in New York fell 2.2% to near $40 a barrel. Libya is moving closer to reopening its battered oil industry after it told companies to resume production at some fields that are free of foreign mercenaries and fighters. This will add to already rising supply from OPEC+ nations, and comes as virus infections are starting to rise again in many places around the world.

U.S. crude jumped 10% last week after a show of determination by Saudi Arabia, the most influential Organization of Petroleum Exporting Countries member, to defend the market. The Saudis hinted they’re prepared for new output cuts, and lambasted OPEC+ nations that have cheated on quotas. Demand and supply worries have returned for investors at the start of this week.

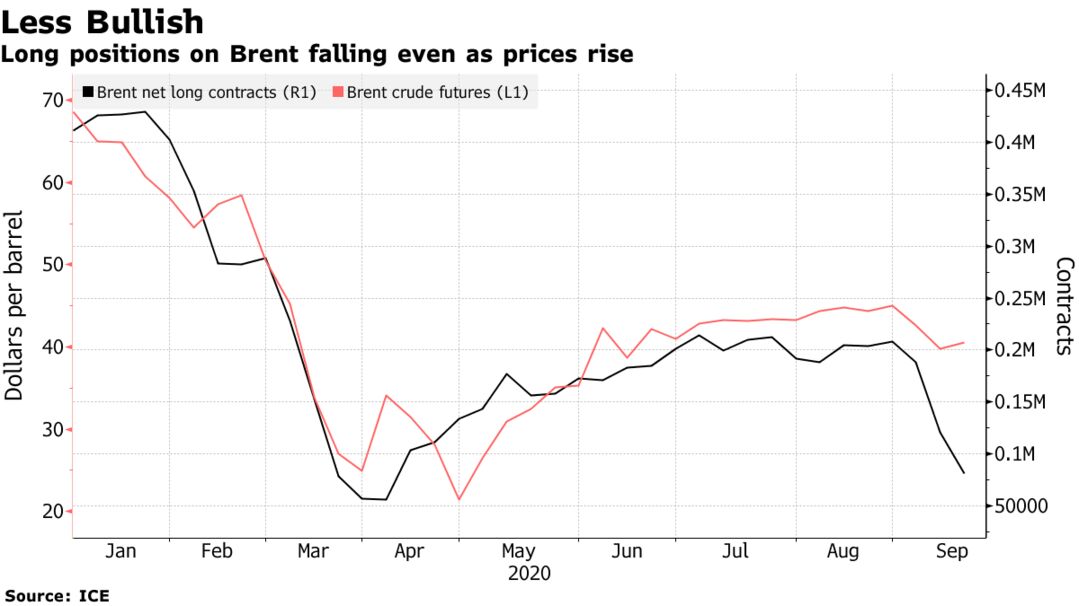

| PRICES |

|---|

|