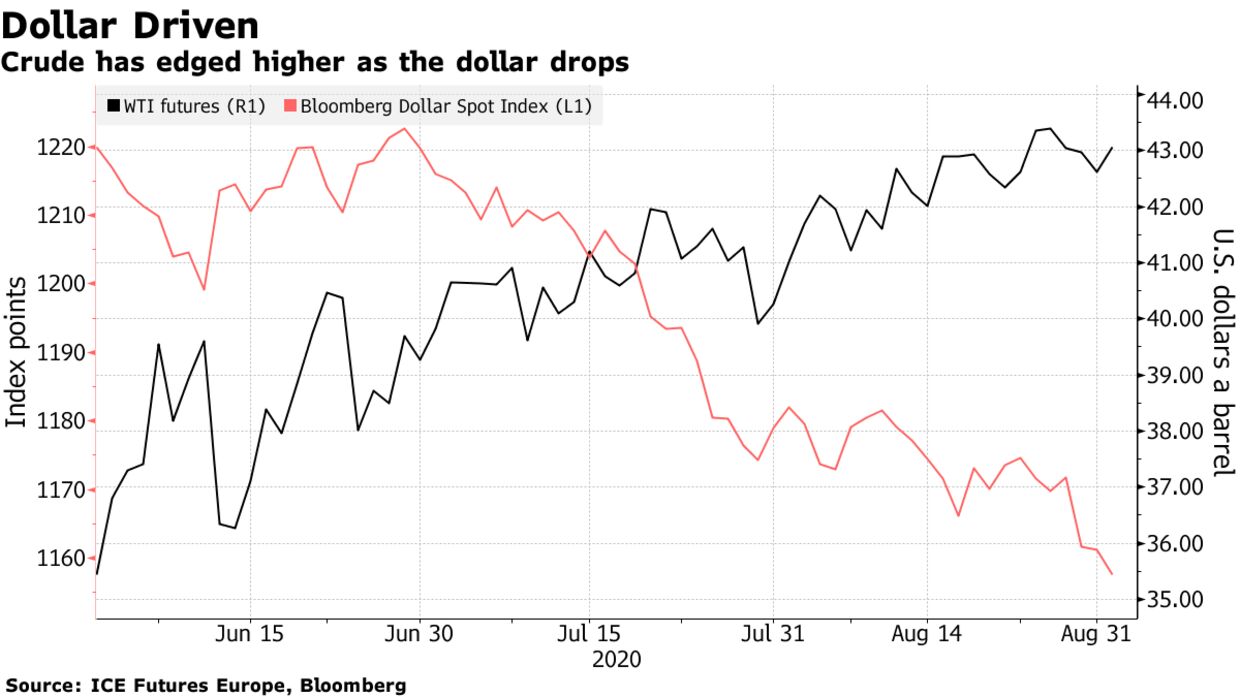

Oil rose to trade near $43 a barrel in New York, with support from a weaker dollar and expectations of a further decline in U.S. stockpiles. Futures added 1.1% after the dollar extended losses to the lowest level since May 2018, making commodities priced in the currency more appealing. American crude inventories may have shrunk by 2 million barrels last week, according to a Bloomberg survey. Meanwhile, healthier manufacturing data in China suggested a renewed pick-up in demand.

Oil capped a fourth monthly gain in August but has struggled to hold above $43 as increasing coronavirus infections raise concerns about the sustainability of the demand recovery. Yet on the supply side, U.S. government figures due Wednesday are expected to show crude stockpiles fell for a sixth week, the longest run of declines this year. In China, a private gauge of factory activity grew at the fastest pace in August since January 2011. Risk-on mode is partly the driver of oil prices,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. The market is also getting “support from better-than-expected PMI data out of China.”

| PRICES |

|---|

|