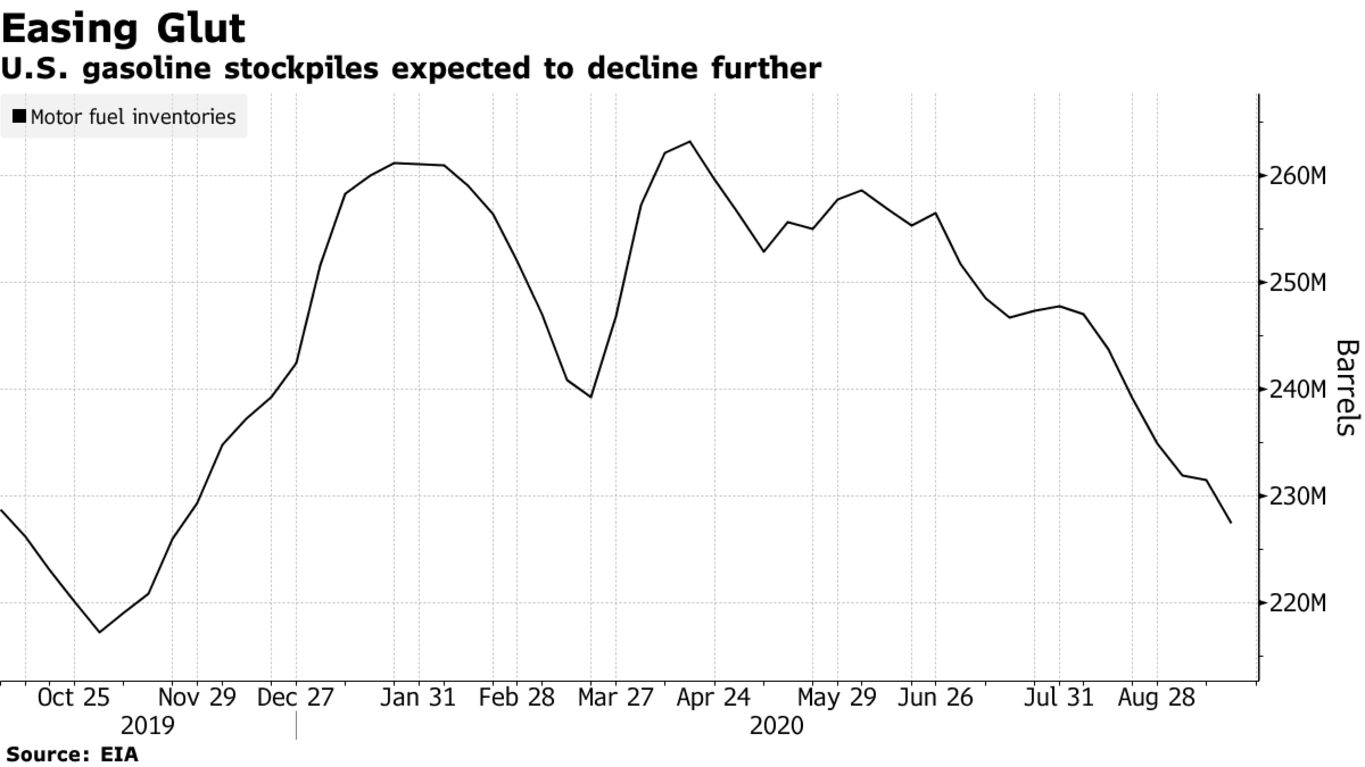

Oil edged lower toward $40 as a global market rally cooled and traders look to U.S. inventory data for clues on-demand recovery. Futures slipped 0.7% in New York, after earlier trading near $40 a barrel. The end-of-quarter rebound in global stock markets stalled on Tuesday, while global confirmed deaths from the coronavirus — which has eviscerated energy demand — hit 1 million. U.S. gasoline inventories are forecast to fall in government data Wednesday as traders assess the health of American consumption.

Oil has clawed its way back after dropping below $40 a barrel earlier in the month, but the world’s biggest oil traders said Tuesday that the market won’t fully recover until 2022. It’s also contending with an increase in supply from OPEC+ members including Libya, which is boosting output as a blockade on its energy facilities lifts.