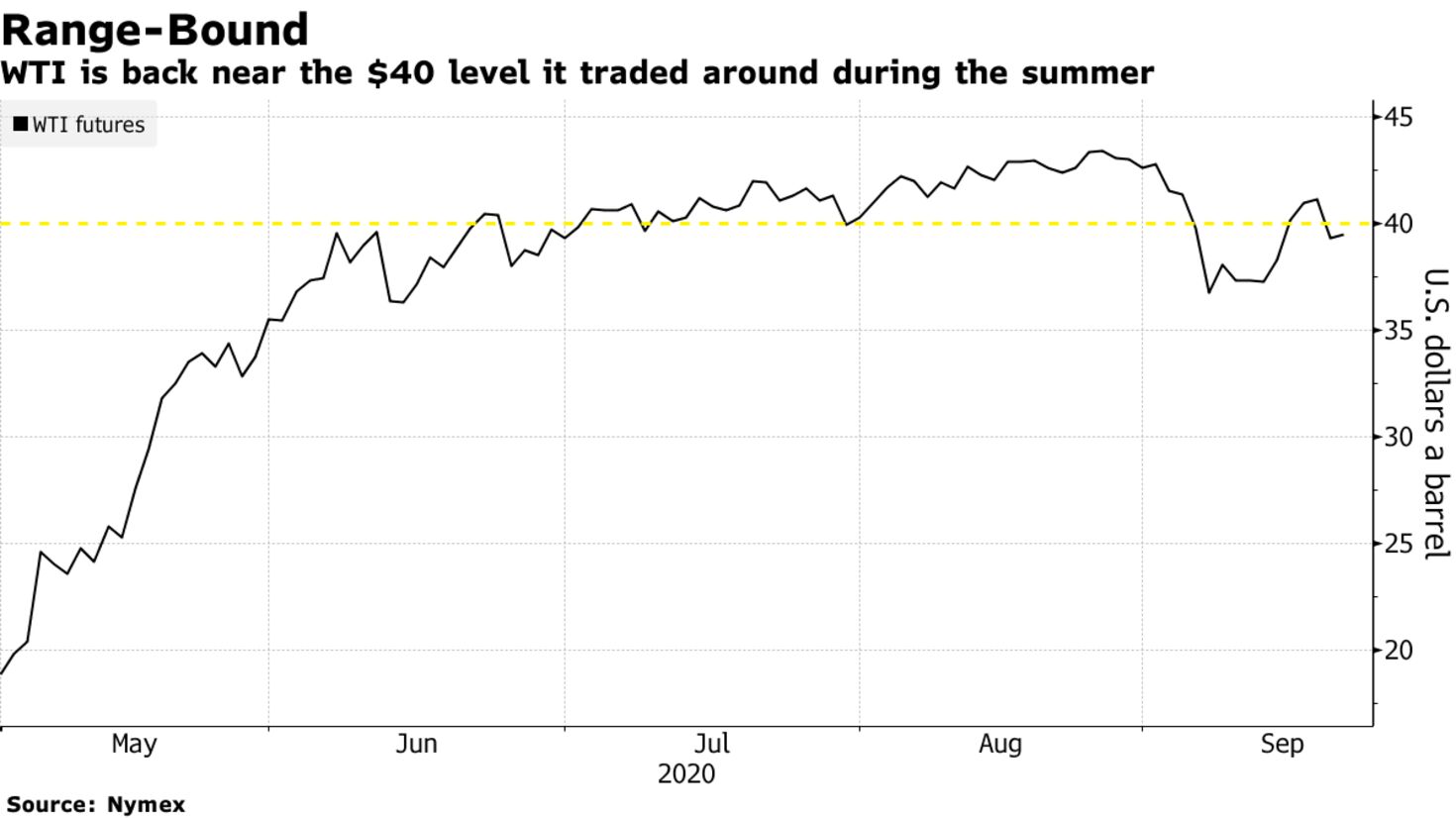

Oil edged higher as positive European manufacturing data and rising equity markets gave some respite to recent demand worries. Futures in New York for November delivery rose to over $40 a barrel. The German economy continues to recover thanks to stronger-than-expected manufacturing figures, data showed, while equity markets in Europe are also stronger. Citgroup Inc. said it remains bullish on the outlook for oil, though the market is undergoing a fitful rebalancing.

After a partial recovery this month, oil prices are now back in the same range as during the northern hemisphere’s summer. With the demand outlook deteriorating in recent weeks, attention is now turning to the OPEC+ alliance and whether it will try to curb output further to rebalance the market. “The API was positive I’d say with draws in gasoline and distillates and crude unchanged,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “A large draw down in the fourth quarter or not is the big question.”

| PRICES |

|---|

|