The guardians of the global economy will gather this week under the cloud of the worst recession since the Great Depression, and a recovery dependent on scientists finding a coronavirus vaccine. The International Monetary Fund and World Bank will hold their annual meetings, with both calling on the Group of 20 largest economies to extend a freeze in debt payments from the world’s poorest nations that’s set to expire at year end. While the fund last week flagged a “small upward revision” to its 2020 growth forecast from its June outlook, it warned the rebound will be long and uneven.

Goodbye V, Hello L

50 years of economic history suggest hopes for a rapid recovery may be optimistic

Source: Bloomberg Economic

The IMF has been encouraging governments to spend whatever they need to confront the crisis, even while warning that debt as a percentage of GDP will rise to about 100% for the first time.

Fund officials earlier this month proposed reforms to debt restructuring for countries that struggle to meet obligations, a burden likely to rise as the pandemic batters economies. Debt vulnerabilities will be a key theme of the meetings, according to first deputy managing director Geoffrey Okamoto. The G-20 agreed in April to waive billions of dollars in repayments by poorer nations until the end of the year under the Debt Service Suspension Initiative. The World Bank says this isn’t enough and wants borrowings reduced to prevent a bigger fallout.

IMF Power Players

The top countries ranked by voting share at the IMF

Source: International Monetary Fund

The IMF has also been working to figure out how to transfer existing reserve assets known as special drawing rights from rich countries that don’t need them to poorer nations that do. A proposal to create $500 billion in SDRs was blocked in April by the U.S., the fund’s biggest shareholder, which criticized the plan as inefficient.

What Bloomberg’s Economists Say…

“With the virus count rising again in Europe, and stalled stimulus negotiations in the U.S., a better than expected third quarter is seguing into a worse than expected fourth. Looking into 2021, hopes for a strong rebound depend on containing the second wave of infections, a stimulus breakthrough in Washington DC, and widespread delivery of a vaccine by mid-year.”

–Tom Orlik, chief economist

Elsewhere, the Nobel Prize for Economics is awarded in Stockholm on Monday and central banks in Indonesia, Singapore, South Korea, Sri Lanka, Chile and Uganda hold monetary policy meetings.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

U.S. and Canada

Federal Reserve Board Vice Chairmen Richard Clarida and Randal Quarles are scheduled to speak Wednesday and Thursday at an Institute of International Finance event that takes place on the virtual sidelines of the IMF meetings.

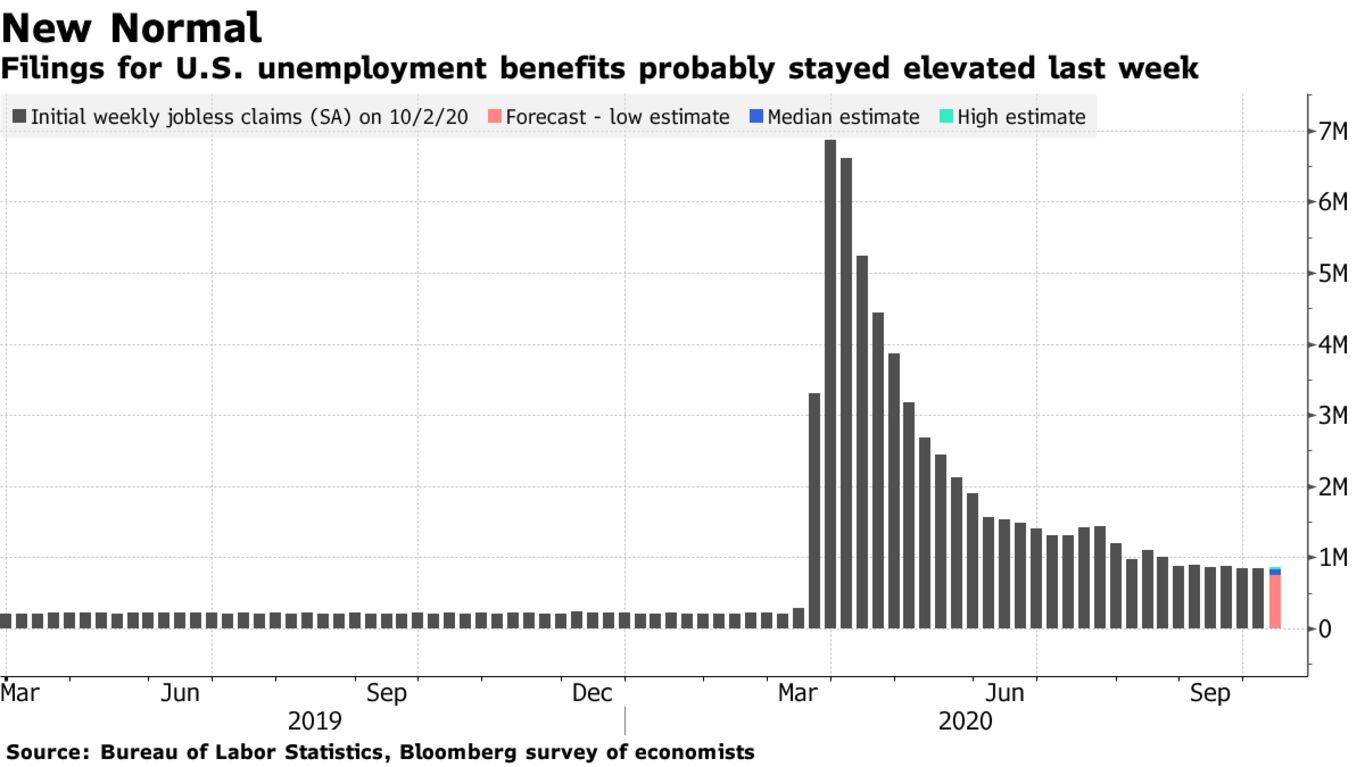

Friday will be the highlight for U.S. economic indicators with releases for September retail sales and industrial production and the Michigan consumer sentiment survey for early October. That’s the day after the weekly jobless claims data.