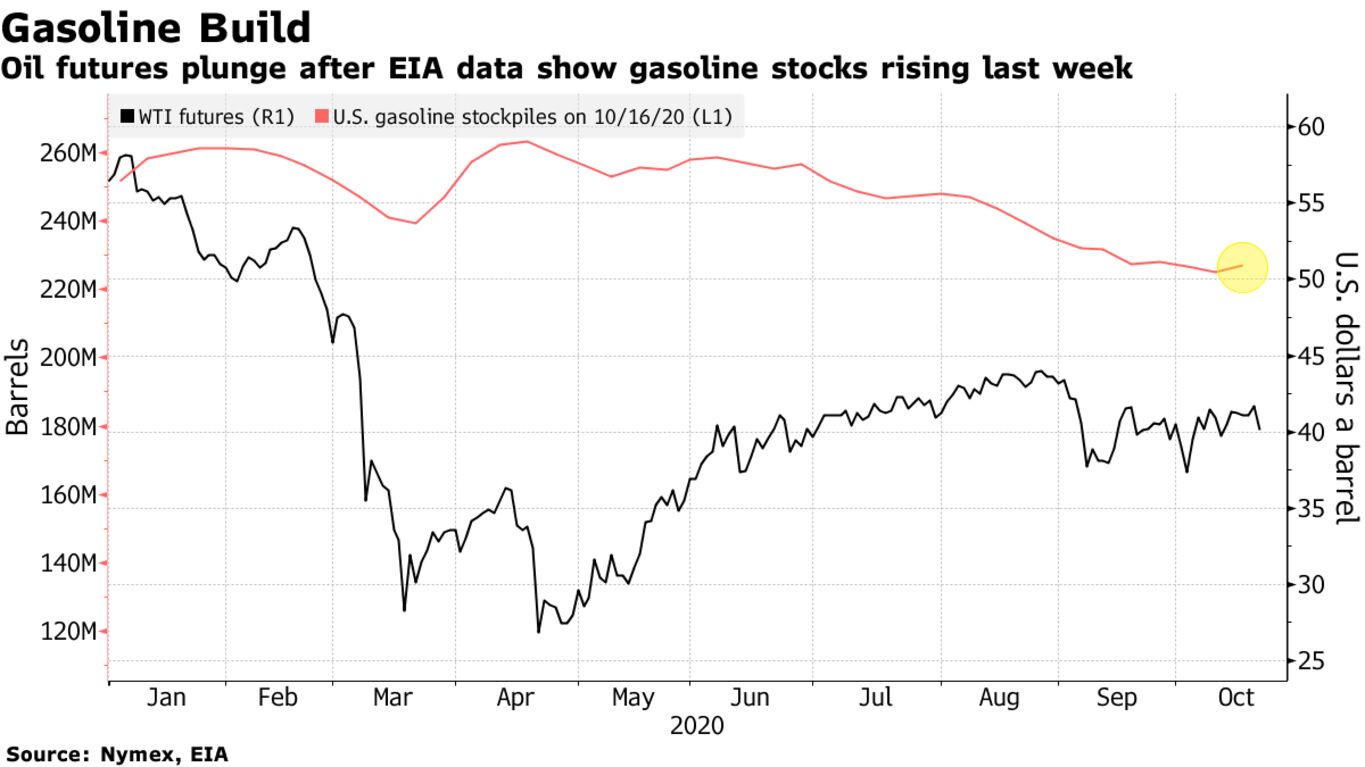

Oil held near $40 a barrel in New York after the biggest drop in two weeks on Wednesday following a surprise jump in U.S. gasoline stockpiles and slowing demand. Motor fuel inventories last week rose the most since May and a measure of the fuel’s consumption slid to the lowest level since late September, according to government data.

Oil is being held in a tight band by a resurgent coronavirus that is threatening demand. At the same time, additional supply is flowing from Libya while the Organization of Petroleum Exporting Countries and its allies are debating if they should follow through on their plan to raise output from January. The group this week warned of a “precarious” market outlook.

“On balance, the sector is doing pretty well considering the increased number of headwinds,” said Ole Hansen, head of commodities strategy at Saxo Bank.

| PRICES |

|---|

|

One bright spot for fuel consumption is China. Traders are buying up cargoes and sending them toward Asia’s biggest economy, hoping to capitalize on an expected surge in demand at the end of the year. Russia’s ESPO crude, a grade often purchased by Chinese refiners, traded at a premium of $2.20 to Dated Brent, traders said.