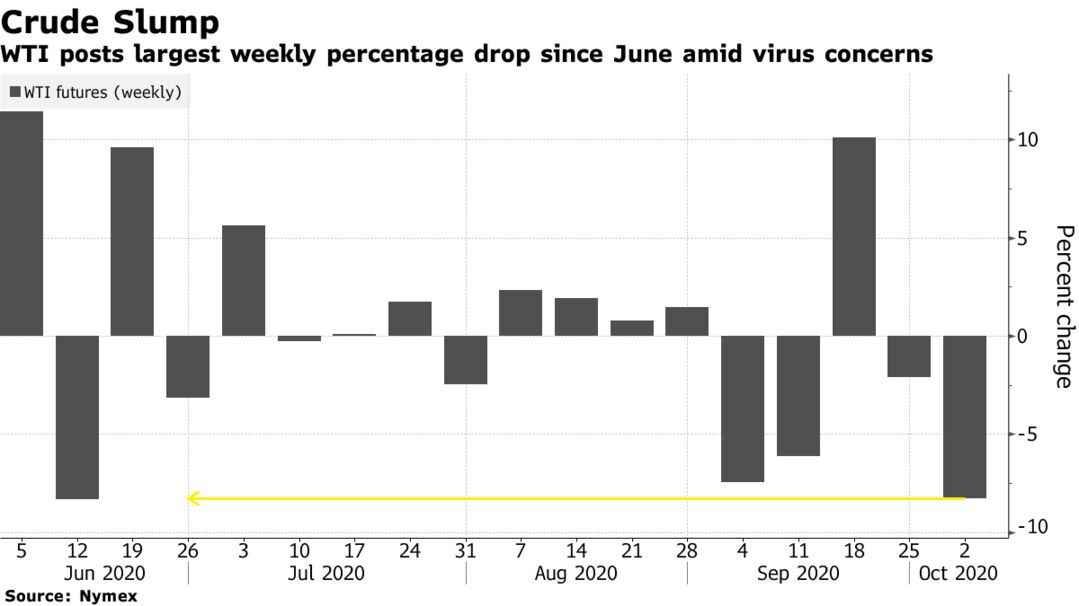

Oil rose from a three-week low after a member of Donald Trump’s medical team said the U.S. President could leave the hospital as soon as Monday, despite contradictory accounts about his health status. Futures advanced 1.6% in New York after the biggest weekly drop since June amid a broader relief rally in Asian stocks. Trump’s condition remained clouded by confusion, with the president making a surprise outing from the medical center in a show of strength. Meanwhile, a strike in Norway is threatening to cut 8% of the nation’s output.

Trump’s recovery have been the subject of intense speculation after a Sunday briefing by doctors raised questions about his condition as he heads into a critical phase. Traders are watching for developments in Norway, where the country’s no. 1 oil company is shutting down four North Sea fields after employers and employees failed to find common ground on a wage deal.

Oil is back below $40 a barrel with a resurgence of the outbreak in some major economies raising concerns about a sustained recovery in consumption. OPEC+ members are also slowly boosting output after historic cuts to prop up prices, while Libyan output rose to about 300,000 barrels a day and U.S. drillers returned more rigs to fields. Still, Norway’s impasse could provide a swift and sharp price lift in the short term.

The news on Trump’s infection on Friday spooked markets, said Howie Lee, an economist at Oversea-Chinese Banking Corp. “Now the shock from Friday is slowly tapering off and market sentiment has improved. It looks like it’s risk-on again.”

| PRICES |

|---|

|

Brent’s three-month timespread was at $1.36 a barrel in contango, compared with $1.17 a week earlier. The change in the market structure indicates that concerns about over-supply are rising.