Oil flipped between gains and losses near $40 a barrel with a challenged demand outlook weighed against a potential U.S. stimulus package. Futures in New York reversed an earlier gain to trade lower. Broader markets rallied on signs of progress for stimulus measures in the U.S. on Thursday. That followed a drop in American crude and distillate inventories in a report by the Energy Information Administration Wednesday.

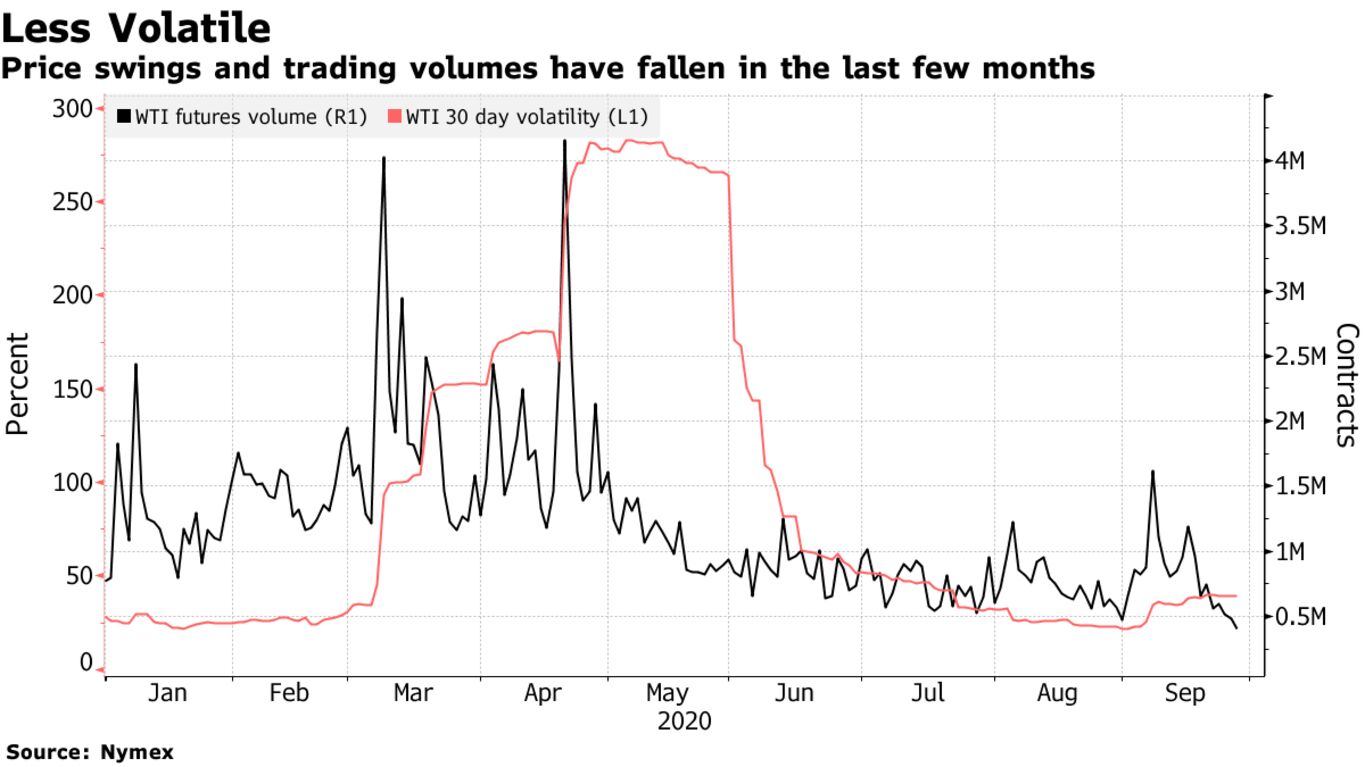

After some sharp price swings in early September, crude is now back in the same range as the previous few months and, given the demand weakness, the risks look tilted to the downside. Some European governments are reimposing lockdown measures to rein in a resurgent coronavirus, while in the U.S. it’s uncertain if there will be any more fiscal stimulus before the election.

| PRICES |

|---|

|

There’s also downward price pressure coming from the supply side, with Libyan output being restored and Russian exports expected to increase. The North African country is now pumping around 300,000 barrels a day, up from 80,000 at the start of September. In a rare positive for oil prices, meanwhile, a strike at Norway’s biggest oil field could disrupt more than a quarter of the country’s crude production.