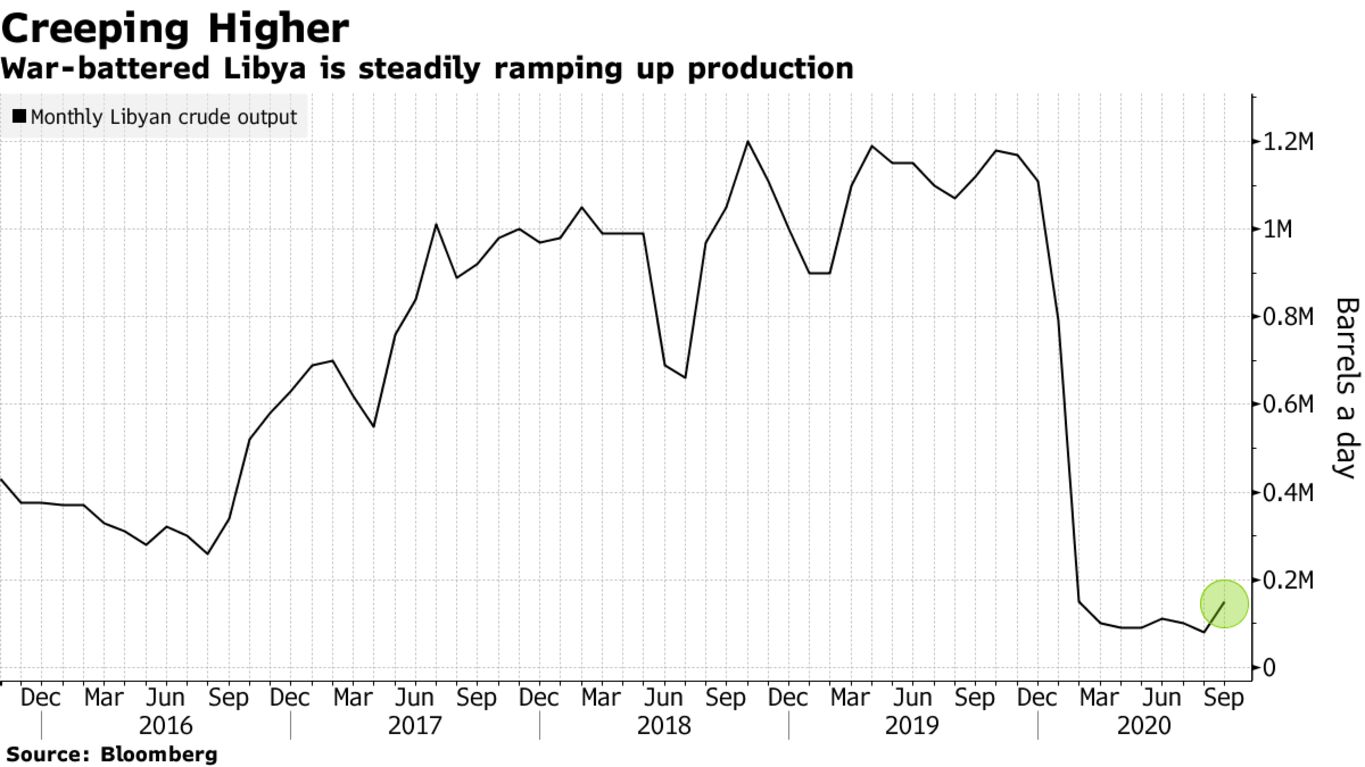

Oil clawed back some losses in New York as the dollar weakened, although rising Libyan production and fading hopes for fresh U.S. stimulus pointed to a bearish outlook for the market. Futures rose 0.8% after tumbling below $39 a barrel on Monday, with a weaker dollar boosting the appeal of commodities priced in the currency. Libya is set to restart the last of its major oil fields following a cease-fire in its civil war, moving the nation a step closer to boosting output to 1 million barrels a day.

While Asia remains a bright spot for global oil demand, a renewed surge in virus cases across the U.S. and Europe is raising concerns the fragile recovery in consumption will be derailed. Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said Monday that the worst was over for the market but urged OPEC+ to stay vigilant and stick to its agreed production cuts.

| PRICES |

|---|

|