The government of Venezuelan President Nicolas Maduro is approaching some of the nation’s creditors in a bid to lay the groundwork for a debt deal should sanctions ease after next month’s U.S. election. His team has convened phone calls with local bondholders in the past few weeks, as well as those from Colombia, Argentina and Europe, according to people familiar with the matter. Prominent investors such as Boston-based Fidelity Investments; Goldman Sachs Group Inc. and BlackRock Inc. in New York; and Newport Beach, California-based Pacific Investment Management Co. aren’t included in the talks due to restrictions imposed by the Trump administration. Spokespeople at those companies declined to comment.

The new discussions reflect an attempt to avoid a flurry of lawsuits from creditors demanding they are reimbursed for missed payments, coupled with the hope that a potential Joe Biden administration would reassess U.S. sanctions that have hamstrung a $60 billion debt restructuring.

Almost three years after defaulting, Maduro has begun to move away from his brand of 21st century socialism and embrace capitalism as the country reels from the Trump administration’s “maximum pressure” campaign. Earlier this month, the Constituent Assembly — formed by Maduro allies in 2017 to rival the opposition-led National Assembly — approved an anti-blockade law to open more industries to private investment.

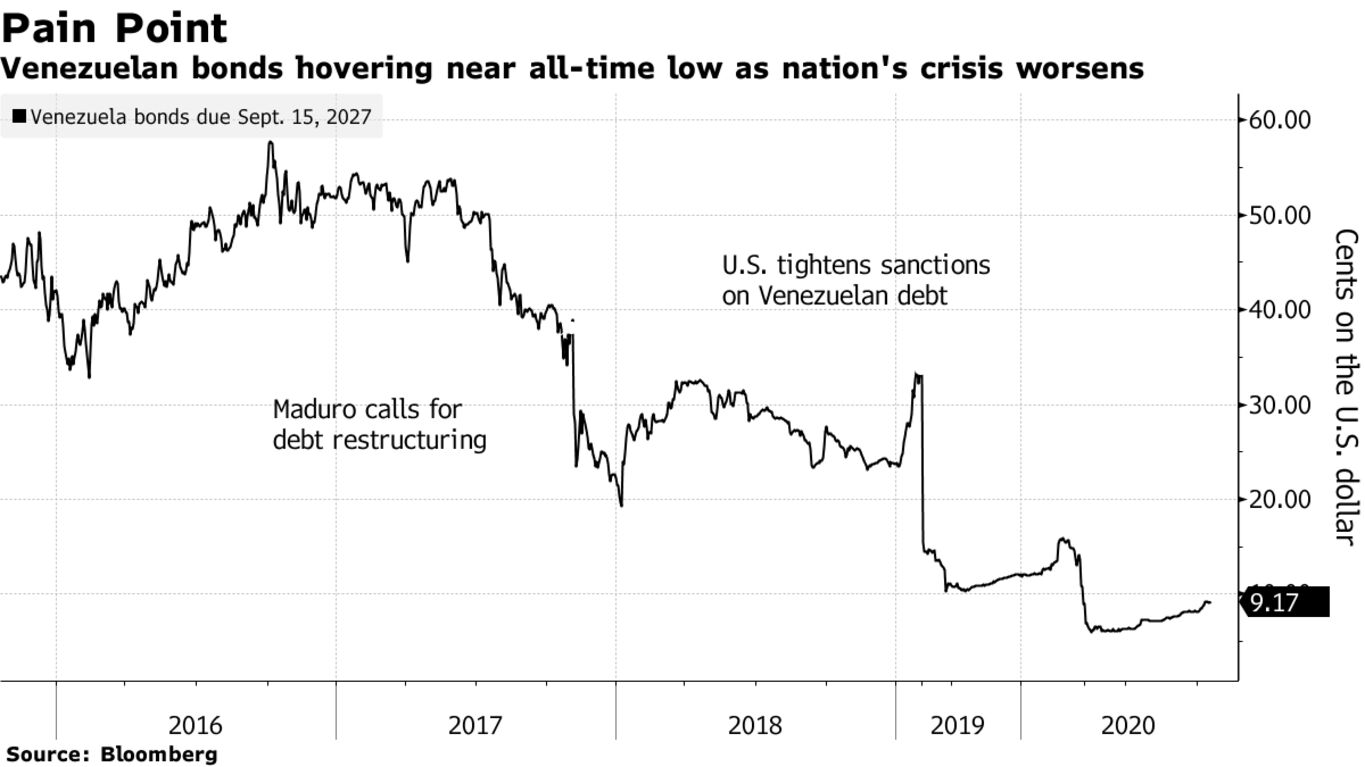

A Venezuelan Finance Ministry official said there was no one available for comment. Representatives for state-run Petroleos de Venezuela, Guaido’s press office and the Venezuela Creditors Committee didn’t respond to requests. The nation’s dollar bonds due in 2027 climbed 0.28 cent on the dollar to 9.40 cents on Monday, the highest in almost seven months. Any bondholder discussions with the socialist government could attract the attention of U.S. officials, who’ve threatened secondary sanctions. New contracts may also get rejected by a future administration in Caracas.

A debt restructuring isn’t practical so long as some of the nation’s top creditors — based in the U.S. — are left out of the talks due to sanctions. “The universe of firms – both local and foreign –that would be willing to deepen ties with Maduro is likely quite limited,” Eurasia Group analysts Risa Grais-Targow and Laura Duarte wrote in a report.