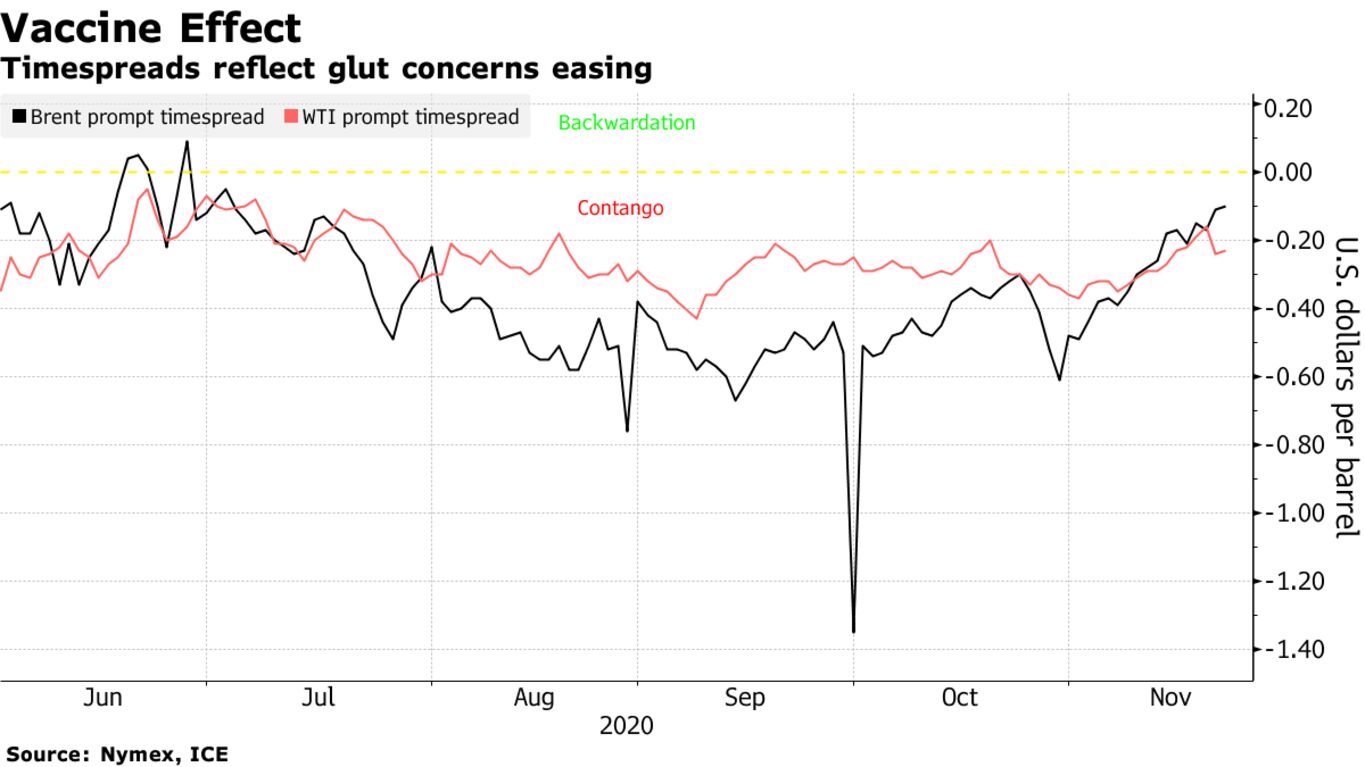

Oil pushed higher after closing at the strongest level since early September as signs that Covid-19 vaccinations in the U.S. could be underway within three weeks improved the demand outlook. Futures in New York rose past $43 a barrel after capping their third straight weekly gain. Vaccinations will “hopefully” start as soon as Dec. 11 or Dec. 12, Moncef Slaoui, head of the American government’s Operation Warp Speed vaccine acceleration program, said on CNN on Sunday.

Crude has jumped around 20% in November as pharmaceutical companies made rapid progress on readying anti-virus drugs. Pfizer Inc. and BioNTech SE requested emergency authorization for their vaccine on Friday and Moderna Inc. released positive interim results from a final-stage trial and said it’s close to seeking emergency authorization.

Optimism that relief from the pandemic is in sight has seen the market look past surging infections and more lockdown measures. The U.S. is now averaging almost 110,000 more daily cases than a month ago, while the opening of a Hong Kong-Singapore travel bubble has been delayed by two weeks due to an uptick in cases in the Chinese territory.

| PRICES |

|---|

|