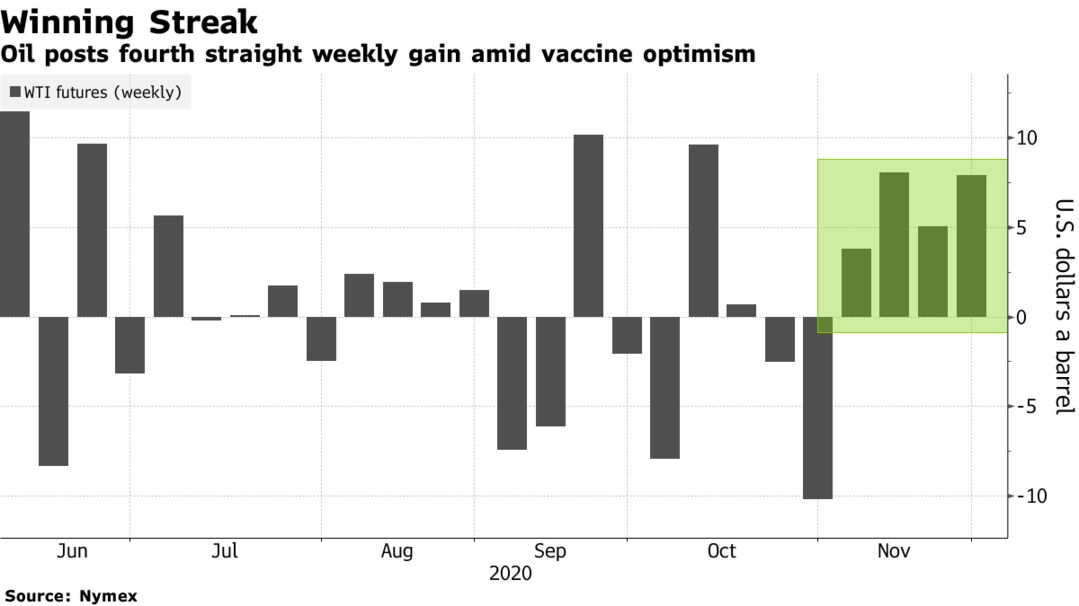

Oil rose for a fourth straight week, buoyed by optimism over Covid-19 vaccine progress ahead of an OPEC+ ministerial gathering next week. Futures in New York advanced 8% this week, despite edging lower on Friday. The shape of the oil futures curve firmed over recent sessions with some nearer-dated futures contracts rising above later-dated ones. It’s a sign of how the market has dramatically repriced the increased likelihood of a vaccine rollout jumpstarting a stronger demand rebound next year.

While most analysts surveyed by Bloomberg are forecasting OPEC+ will postpone the planned increase by three months to March, oil’s recent rally may further complicate the decision amid growing tension with some member countries. Meanwhile, Algeria, which holds the rotating OPEC presidency this year, said the group must remain cautious because the organization’s internal data point to the risk of a new oil surplus emerging next year. That’s if the cartel and its allies go ahead with a supply hike.

| PRICES |

|---|

|

The OPEC+ alliance’s agreement is expected to be in place throughout 2021 and the group will delay its planned tapering by three months, JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a report. The bank says inventories will decline by 1.2 million barrels a day on average next year, though demand still won’t reach normal levels until 2022.

Alongside strong demand from Asia, there are signs consumption is also gradually improving elsewhere. Foot traffic in U.S. airports hit the highest since March before the Thanksgiving holiday, though it remains about 1.5 million people lower year-over-year, according to data from the U.S. Transportation Security Administration.

Still, in the near-term, there is the lingering threat of further lockdown measures due to the pandemic. Refiners globally will have to keep runs low until at least the second quarter of next year to prevent significant gasoline stockpile builds as lockdowns result in reduced mobility and weaker demand, according to a note from FGE. That’s as refiners continue to contend with razor-thin margins. The combined refining margin for gasoline and diesel is at its lowest seasonally since 2009.