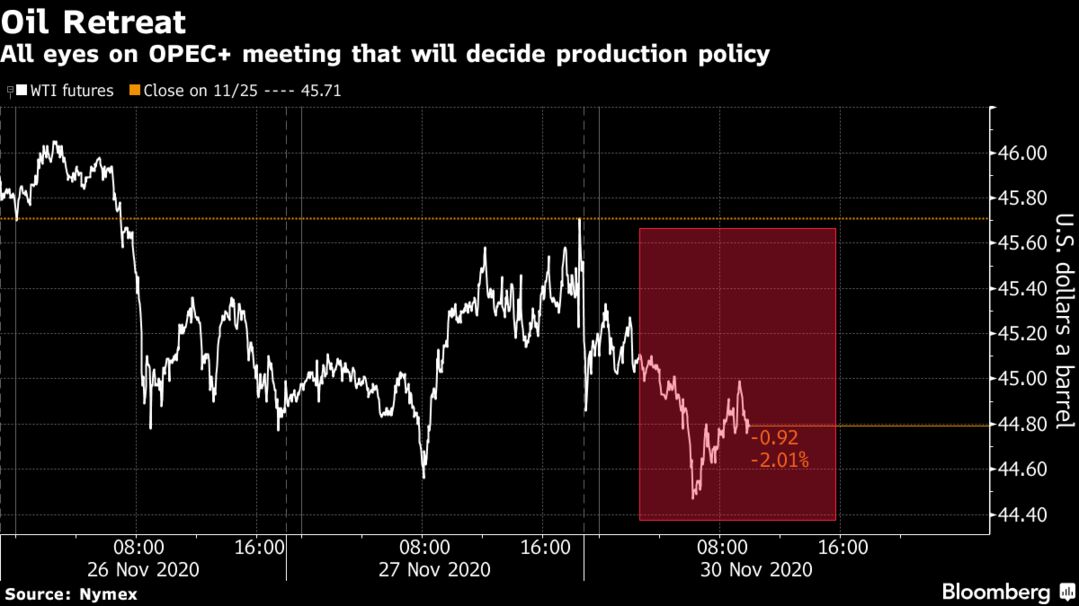

Oil dropped below $45 a barrel as a consensus within OPEC+ to postpone an output hike planned for January remained elusive ahead of a meeting of the cartel’s power brokers later on Monday. Futures in New York declined 1.7%. Most participants in an informal online gathering of OPEC+ ministers on Sunday supported keeping production curbs at current levels into the first quarter, said one delegate, although there was opposition from the United Arab Emirates and Kazakhstan.

Oil is still set for the biggest monthly gain since May as Covid-19 vaccine breakthroughs raised optimism for a long-term rebound in fuel consumption. Yet failure by OPEC+ to agree on extending output curbs would see producers restore about 1.9 million barrels a day in supply, potentially pushing the global market back into surplus.

“The current grumbling is part of the game,” said Hans van Cleef, senior energy economist at ABN Amro. “It is a matter of finding a balance between generating sufficient income and not flooding the market with oil. I personally think that they will postpone the previously agreed production increase by three months and then gradually increase it.”

| PRICES |

|---|

|