Oil rose toward $42 a barrel in New York, as signs of a robust demand recovery in Asia offset a jump in U.S. crude stockpiles. West Texas Intermediate futures advanced 1.1%, buoyed as a decline in the dollar enhanced the appeal of commodities priced in the U.S. currency. Refiners in China, Japan and South Korea snapped up cargoes from Russia, the Middle East and the U.S., leading to a gain in physical crude prices. Buying interest has been strong after some refiners got less oil than usual in term supply contracts from OPEC producers Saudi Arabia and Iraq.

The American Petroleum Institute reported on Tuesday that crude inventories swelled by 4.17 million barrels last week, according to people familiar with the matter. That’s more than double the increase expected from government data due later today.

Meanwhile, OPEC and its allies gave reassurance at a committee meeting on Tuesday that they’re ready to act to keep markets stable later this month. The OPEC+ coalition is increasingly minded to delay plans to restore more of the output they’ve halted this year to stave off a glut.

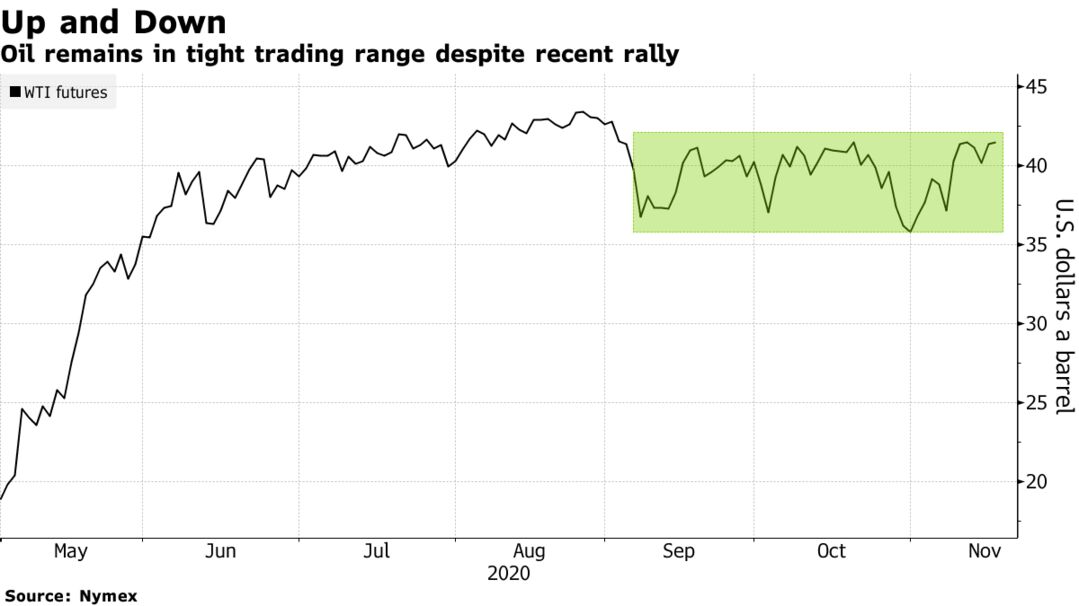

Oil rallied above $42 a barrel on Monday after news of another Covid-19 vaccine breakthrough, but prices have since lost some ground as the market grapples with an uneven demand recovery. A resurgent virus in Europe and the U.S. is sapping fuel consumption, compared with Asia where China’s rebound is accelerating and refiners are buying more crude.

| PRICES |

|---|

|