Joe Biden made it clear on the campaign trail that he planned to take strong action to fight global warming. But his ambitious, $2 trillion climate plan will take time and resources. In the meantime, here are some of the smaller, immediate steps he can take — and a few that are probably much harder than they look.

The Easy Way to Slow Fracking

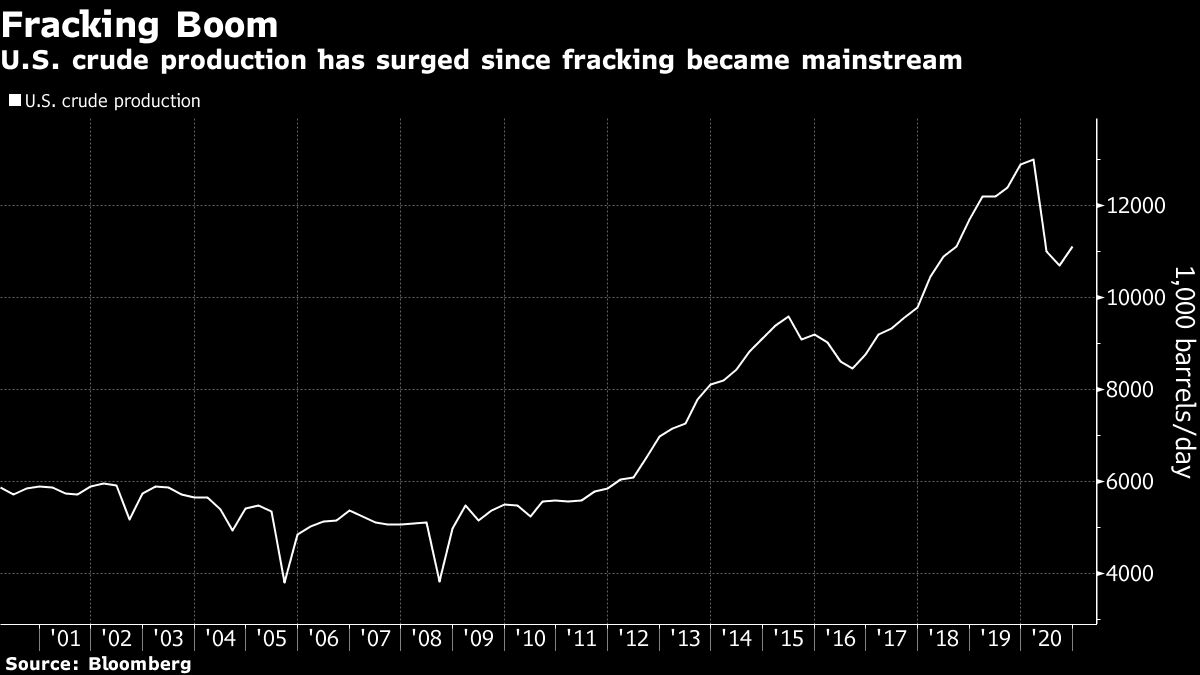

Biden’s been adamant that he won’t ban fracking, but there’s another way he can curb fossil fuel production and emissions: by jamming up the process for federal oil and gas leasing.

The president-elect can call for a comprehensive review of the Bureau of Land Management’s leasing program, a process that could potentially take years, said Katie Bays, an analyst for FiscalNote Markets. While it’s happening, the agency isn’t allowed to issue new leases, and the industry can’t appeal or block the move until the review is complete.

President Barack Obama did the same thing with coal mining in 2016. It would be easier than an outright ban on new federal leases, which would likely draw legal challenges from fossil fuel companies that could slow the rollout of new regulations. The move would affect most new wells in the New Mexico Permian Basin, one of the most prolific shale fields in the U.S., with some of the lowest breakeven costs in the country.

A Backdoor Carbon Price

Getting a carbon tax passed through a divided Congress would be tough, but there is one agency that can set the stage for regional carbon prices: The Federal Energy Regulatory Commission, which oversees U.S. electricity markets.

Biden can immediately appoint a new chairman to the commission and, within months, flip control of the five-seat panel to Democrats. The agency is already looking at carbon pricing in regional power markets and could finalize its position next year, according to Timothy Fox, a vice president at Clearview Energy Partners.

Caveat Investor!

The president-elect can also appoint a new chairman to the Securities and Exchange Commission, setting the stage for financial markets to better evaluate and price climate risk. The new chair could require companies to disclose climate-related threats facing their assets, said David Victor, a professor of international relations at the University of California at San Diego.

Investors could then use the data to predict the long-term value of companies across almost every industry and identify which ones face the biggest potential losses. “Guidance from the SEC and central banks about market risks will be significant,” said Victor.