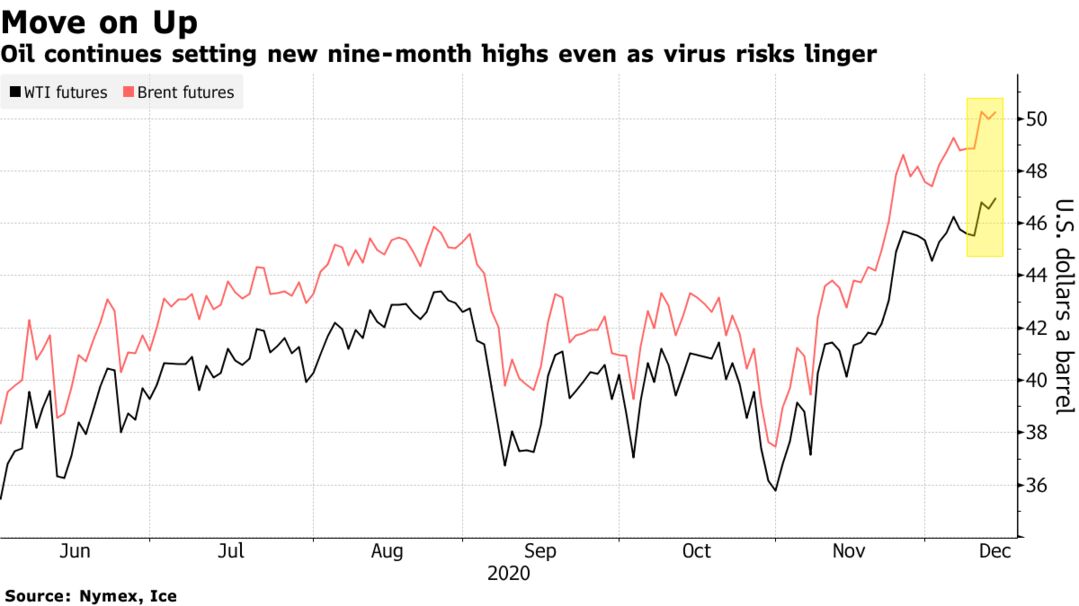

Oil inched up as the market weighed the risks of toughening restrictions in New York and London ahead of a widely available vaccine. Futures closed at a fresh nine-month high after swinging between gains and losses earlier. The U.S. began administering the Covid-19 vaccine alongside nationwide immunization campaigns in other countries, presenting a path toward a normalization of crude demand.

“The market is betwixt hope and reality,” said Andrew Lebow, senior partner at Commodity Research Group. “A lot of this rally is hope that demand growth continues because of broader distribution of the vaccine. The reality is we’re still seeing tightening lockdowns in Europe and now there’s potential for lockdowns in New York.”

Historically high levels of crude stockpiles indicate global demand has a ways to go before bouncing back to pre-Covid levels, with government efforts to control the spread of the pandemic remaining a persistent near-term headwind.

U.K. Health Secretary Matt Hancock told the House of Commons on Monday that a new variant of the virus has been identified and could be driving the rapid rise in cases. The tougher restrictions in London and parts of south-east England will strike a huge blow to businesses just days before the U.K. is given a five-day relaxation of the rules over Christmas.

| PRICES |

|---|

|